FinTech

India neobank Zolve closes $40M Series A funding round at a valuation of $210M, will scale financial services for US-bound immgrants

With these additional funds, Zolve intends to enhance the user experience for global citizens, allowing them to open their U.S. accounts in minutes. Moreover, the funds will help speed expansion of the service to more nationalities, increasing the number of people who can start building their financial futures from the moment they arrive in the U.S.…

October 28, 2021

FinTech,TNGlobal Q&A and Interviews,Malaysia

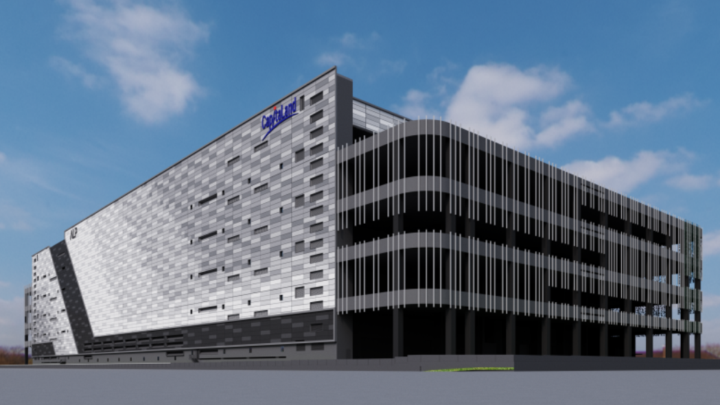

Angkasa-Boustead consortium banks on Islamic bank positioning, existing captive members to win a digital banking license in Malaysia [Q&A]

In the interview, Hudhaifa shared the opportunities the consortium sees in building a digital bank in Malaysia and what are the competitive advantages it has against other contenders vying for the digital banking licenses. He also shared his views on the profitability path for digital banks, citing examples from other countries.

October 27, 2021

News,eCommerce,Thailand,FinTech,Malaysia

Omise targets to triple transactional processing volume in Malaysia as it launches operations in the country

Businesses operating online in Malaysia now have access to the full strength of Omise’s modern payment gateway to accept payments securely, manage transactions, send payouts, and expand operations regionally to capture more sales and grow revenue. Meanwhile, businesses using Omise in Thailand, Japan, and Singapore can seamlessly expand their business and…

October 26, 2021

India FinTech SaaS firm Clear raises $75M Series C to accelerate B2B and international expansion

The funds will be used to accelerate Clear’s expansion into Business to Business (B2B) credit and payments plus expansion into international markets.

October 25, 2021

News,FinTech,Asia,Mergers and Acquisitions

Stripe to buy India-based payments reconciliation software provider Recko

Stripe has entered into an agreement to acquire Recko to help its internet businesses automate payments reconciliation.

October 25, 2021

TNGlobal Insider,FinTech,Blockchain / Crypto

The future of banking: Immersive banking – the holy grail (part 3 of 3)

In this new paradigm, key services such as deposit-taking service, asset-custodian, insurance, lending services, risk management, and the offer of securities, etc. will be redistributed between different tech layers and service providers. New capabilities, such as smart contract audit or underwriting (for non-crypto assets) could also be created along the…

October 23, 2021

News,FinTech,Mergers and Acquisitions,SEA,Malaysia

ASX-listed Novatti acquires Malaysia FinTech firm ATX Group for up to $7.4M

The acquisition enables Novatti to scale existing ATX businesses while looking to introduce additional Novatti services to the Malaysian market, such as billing.

October 20, 2021

News,FinTech,Singapore,Investments

Singapore-headquartered trading app MarketWolf secures $5.5M Seed funding

MarketWolf had raised $1.7 million during its angel round and has raised a total of $7.2 million to date. This fresh funding will be utilized to build new products, expand the user base and attract top talent

October 20, 2021

SEA,eCommerce,Startup Profiles,FinTech,Indonesia,TNGlobal Q&A and Interviews

Bezos-backed Ula to scale up ‘pay later’ options for underserved small retailers in Indonesia

Indonesia’s retail market is estimated to be around $300 billion, of which 70-80 percent is traditional retail--with this market growing 8 percent year on year, the potential is enormous.

October 14, 2021