FinTech

Temasek joins fintech firm iCapital’s $820M funding round

ICapital, the global fintech company, announced Thursday it has raised over $820 million with the completion of its latest financing round, bringing the company’s valuation to over $7.5 billion.

July 11, 2025

Malaysia’s Paydibs onboarded as direct third-party acquirer for FPX by PayNet

Paydibs, a payment solutions provider in Malaysia, has announced its official onboarding by Payments Network Malaysia Sdn Bhd (PayNet) as a Third-Party Acquirer (TPA) for the Financial Process Exchange (FPX).

July 10, 2025

ShopBack secures MPI license from MAS for digital payments

ShopBack, a Singapore-based shopping, rewards, and payments platform, announced Tuesday that it has been granted a Major Payment Institution (MPI) license by the Monetary Authority of Singapore (MAS) for digital payments.

July 10, 2025

Singapore fintech firm Finmo secures UK EMI license, expands global footprint

Singapore-based fintech company Finmo has received approval from the UK Financial Conduct Authority (FCA) to operate as an Authorized Electronic Money Institution (EMI).

July 10, 2025

News,Singapore,Malaysia,FinTech

Curlec, ShopBack Pay join forces to support reward-driven checkout for Malaysian businesses and shoppers

Curlec by Razorpay, Malaysia’s FinTech payment gateway, has forged a strategic partnership with ShopBack, Singapore’s platform for shopping, rewards, and payments, to support reward-driven checkout for Malaysian businesses and shoppers.

July 9, 2025

Singapore’s SME Fintechs blocked from growth due to restricted API access, reveals new Fintech Nation report

A new report by Fintech Nation revealed on Tuesday a significant obstacle to fintech-led innovation in Singapore’s small and medium-sized enterprise (SME) sector, with 85 percent of fintechs reporting they have been denied or delayed access to essential banking APIs by incumbent banks.

July 8, 2025

Tracxn : SEA FinTech funding falls 22 percent year on year to $776M in the first half

Southeast Asia Fintech players have raised a total of $776 million in the first half of 2025, up 31 percent from $593 million in the second half of 2024, but down 22 percent as compared to $1 billion raised in the first half of 2024, Tracxn said Monday.

July 7, 2025

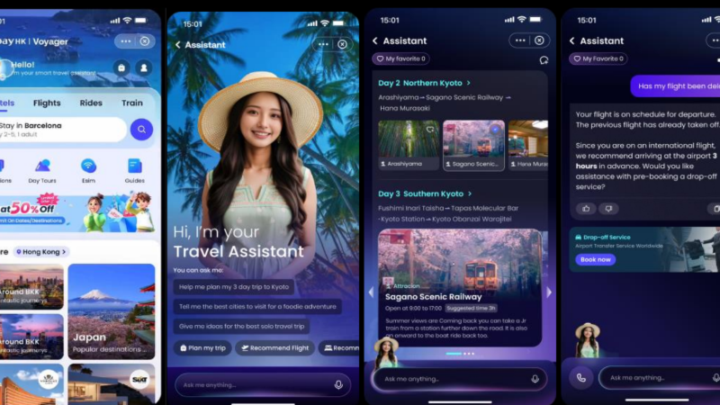

Ant International launches built-in end-to-end AI travel companion for digital wallet, super app users with partners

With launch partners including Fliggy, Agoda and Trip.com, Ant International has introduced Alipay+ Voyager, an artificial artificial intelligence (AI) travel companion integrated into digital wallets for the travel industry to simplify and enhance travel experiences for global consumers.

July 7, 2025

Singapore’s XL Ventures secures In-Principle Approval for capital markets services license

XL Ventures Pte Ltd, a Singapore-headquartered climate tech focused company, has received In-Principle Approval from the Monetary Authority of Singapore (MAS) to perform licensed Venture Capital Fund Manager (VCFM) activities in Singapore.

July 4, 2025

TNGlobal Q&A and Interviews,SEA,Features,Singapore,FinTech

Ant International’s AI Blueprint: Powering Payments and Digitalization for SMEs [Q&A]

TNGlobal recently talked to Jiangming Yang, Chief Innovation Officer of Ant International, to learn more about the company’s AI strategy, how it can help to empower small and medium enterprises (SMEs), and the markets the company is looking at.

July 4, 2025