This is the third and final article of a series on the future of banking by Genping Liu, Partner at Vertex Ventures Southeast Asia and India fund.

Thanks for following my 3-part series on future of banking. If you missed the previous posts, here’s the link to Part 1 and Part 2.

When I started looking at FinTech six years ago, I recalled asking my colleagues point blank: “Why do we still need banking?”

For one, fintech startups are already outperforming banks in terms of functionality:

- On interest yield: The younger generations are more sophisticated in investing and expect much better yield than the low interest rates that banks offer.

- On trust: there used to be a fear that the neo-banks could not be trusted, yet this has proven to be not the case. Revolut, a neo bank founded in the UK, has 16 million users.

On the crypto side, Bitcoin is rapidly being recognized as a “trustless” platform that gives us back the control and ability to serve our own basic banking needs:

- On remittance/ cross-border transfers: Startups like Transferwise and cryptocurrency platforms offer much more attractive rates and faster transfer speed.

- On loans (particularly personal and education): many tech companies also offer cheaper rates and better access than banks.

So why do we still need banks?

Perhaps, the most convincing reason to explain why we still need banks is due to the license moat and fractional reserve that the banking system (still) possesses–which is an artificial barrier. This gives banks the low-cost capital edge. Yet, this is not an elixir pill.

Over the past decade, we have seen the decoupling of infrastructure and direct customer relationships in several sectors like telecommunications and utilities, etc. The current moat that banks possess is not sufficient to avert the fate of being potentially reduced to a pure infrastructure play. This could mean losing most of the end client relationships that banks traditionally value the most. I have a feeling the reality of this happening is simply a matter of time.

Well, in the near future, we are likely to still have banking accounts with the traditional banks, especially if the industry-wide disruption in the banking sector remains at a snail pace. However, by the end of this decade, when the changes discussed in Part 1 and 2 come together, the network effect might lead to a tipping point in the whole banking disruption story.

After all, regulators are already massively pushing for an open banking system. Technology disruptions are coming from both within the traditional banking infrastructure, and from the novel blockchain world where innovations are happening at lightning speed (excuse the pun 🙂 ). Furthermore, clients are constantly demanding new capabilities and good banking experiences.

There will be more and more new entrants

New players include all types of mega-tech companies, young startups, and loads of risk capital. The list recently expanded with the entrance of hedge fund players (who probably think that VC funds are not taking on enough risk) … all this seems to be a perfect storm for an impending great disruption!

With many categories of players vying for the throne to lead the future of banking, I am just not so sure what the future for banking holds. As an end-user, I can only focus on what kind of banking experience I want. I want it to be different from the current banking experience.

Various theses on the future of banking experiences

In fact, when it comes to future banking experiences, I notice that there are many different theses. Many would suppose that the WeBank/Alipay (putting regulation risk aside) or SuperApp thesis to be the most likely winner. Apart from that, there is the “banking everything” or “Smart banking powered by AI” type of theses.

While these theses present improvements to the banking experience, to me, they seem to be simply a better version of the current banking model. Sorry to sound audacious but this is not actual disruption, but just mere optimization.

We are too spoiled for choices and the complexity increases with the pace of innovation

While the proliferation of fintech apps opens up an array of choices and rich experiences, there are too many products offering specialized banking/ financial features. Hence, therein lies the problem of fragmentation–many of you could have felt the pain of checking through and experimenting with so many fintech Apps just to earn a few more percent in interest. It also doesn’t make sense to have my small amount of funds spread across many different apps. Furthermore, the landscape doesn’t stay static–there will always be more and more useful apps coming into the market.

On one hand, I would like to continue exploring more deeply into fintech, yet on the other hand, it is getting too much to manage. How can all of these technological offerings be unified under one roof?

My Ah-ha moment

My inspiration came when I stumbled upon MAS Chief Ravi Menon’s Speech, and I learned about the concept of Entity based vs Activity-based regulation.

Entity based vs Activity-based approach

It was then that I realized that most of the fintech innovations I would like to try out are just activities, whereas I would love for my money to be residing with an entity.

However, as a technology solution, I would go a step further than what Ravi Menon has shared. Imagine this, if this entity were a “central bank” or a “trustable machine” of an open crypto network, wouldn’t it make our lives simpler?

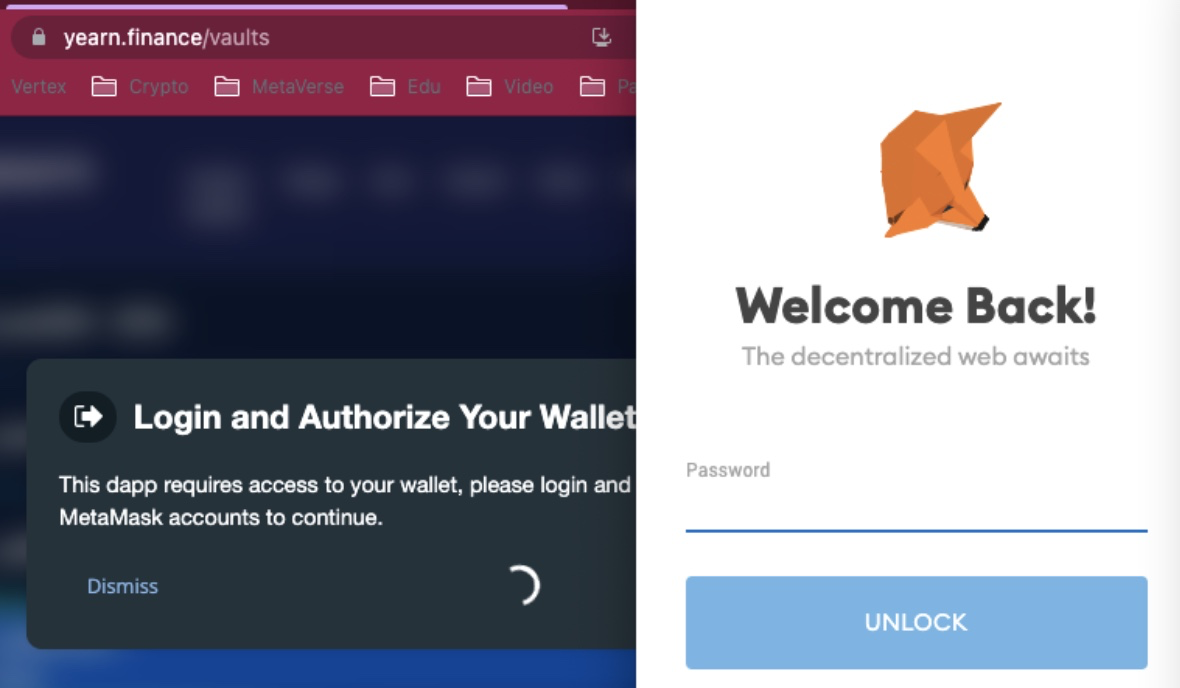

With this, it dawned on me that the best banking experience I’ve had so far was actually with Metamask–a crypto wallet, or web3 browser.

Could Metamask be the elixir?

For those of you who have used Metamask before, you might be shaking your head subconsciously, in disbelief. But just hear me out.

With a CHROME plug-in, you can interact with any website that offers an Ethereum blockchain-based Dapp (decentralized applications). In this model, the entity will be the Ethereum blockchain, which I trust (this could be a central bank if CBDC is the transacting currency). The activities will be the equivalent of the Dapps offering different capabilities and services which are built on the entity.

Metamask enables a truly plug-and-play ecosystem

In this ecosystem, Dapps offer the rich banking experiences and Ethereum provides the trust element; while MetaMask acts as the ‘plug-in’ that provides the capability to access your experiences and simplify administrative tasks (Admin) to manage the transactions. This would allow the Dapps (application layer) to focus on its own value proposition. Contrast this with the current FinTech play, where the startup/tech application typically needs to perform everything, I believe the combination of Metamask and Dapps offers a more seamless experience.

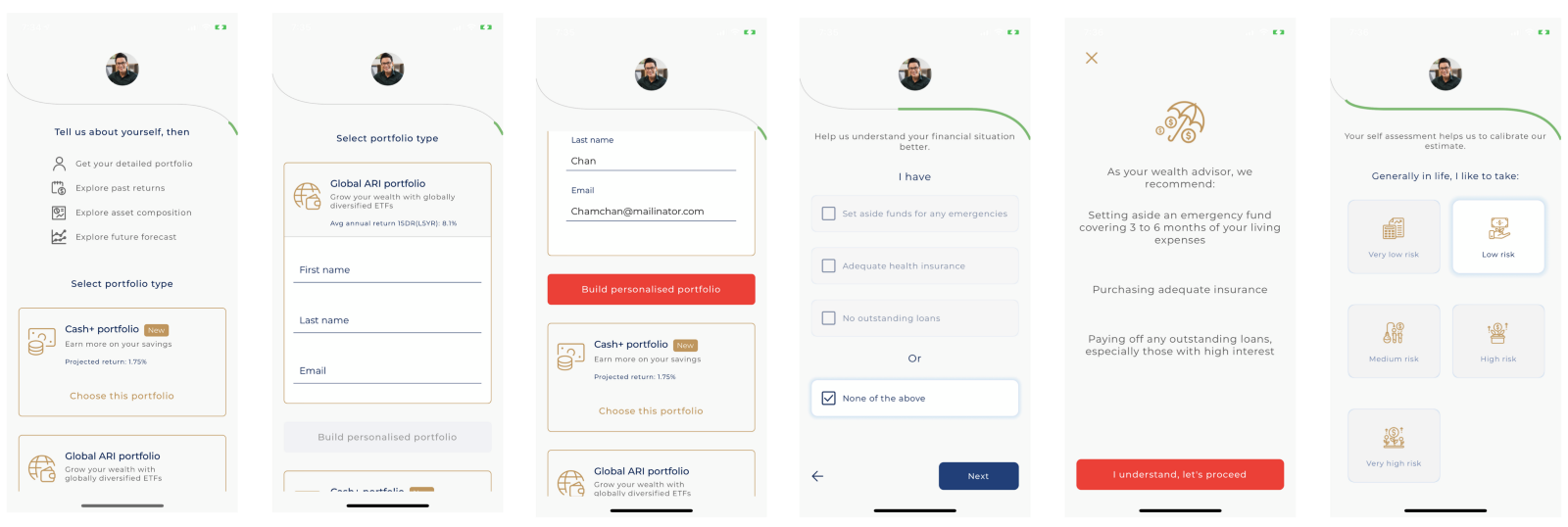

Let’s do a comparison. Currently, let’s say you would like to use a Robo Advisory product, you would have to:

- First need to go through KYC and perform Admin tasks;

- Send in your money (in good faith);

- Choose an investment strategy–note actually this is the most value-adding task, as the other tasks are just there to make this possible;

- And finally make sure you won’t forget this app amidst the many other apps that you are testing out.

- When you find a better option, then you will then need to redeem the product, and withdraw the money to your bank account. To try another product, you would have to repeat the process all over again.

To me, this is a lot of work, when all you want is just the activity the product offers to help you allocate some of your money into different interest-earning assets.

Then, compare this to using say, the Yearn.finance Dapp (this is the closest crypto product to Robo advisory that I can find):

- You would visit the site, choose a product, connect to your MetaMask wallet and approve the transaction. Hoo-ah! The money is invested and tracked for you on MetaMask.

- If you would like to try out a competing product, simply redeem it on Yearn.finance. The investment would be returned back to your Metamask account automatically.

- To try another product, you just need to connect the app to your MetaMask wallet and repeat the above process. This helps to skip the step of depositing the money back to your bank account and then transferring it to the other product.

I call this ‘Immersive banking’–we are not talking about Augmented Reality or Virtual Reality here, but referring to how Metamask provides an overlay over the context, and is not totally embedded into the context.

The future is about returning the power to the end-users

To discuss the future of banking holistically, we can’t ignore the transition in our own mindsets as well. The Web 3.0 movement where end users are taking back control of their data is growing. I see this as another trend that will fuel the use of tools like MetaMask to disrupt the future of banking.

To reiterate, I don’t have a crystal ball and I’m not saying this is definitely the way of the future, but what I just discussed is a peek into the future possibilities.

With the financialization of everything, I (and I believe many of you as well) would like a provider that can help me manage all the different types of monies (asset or money), and provide much of the rich experiences and value-adding activities from all those innovations.

As money becomes more programmable, a hybrid of the open-banking infrastructure and the crypto infrastructure could be the key to creating the ultimate immersive experience we have all been seeking.

Conclusion

To conclude, I have a feeling that this MetaMask experience of ‘immersive banking’ could serve as an example of what the Future of Banking looks like. It would enrich users’ banking experience and allow them to seamlessly interact with an endless array of financial services, like a plug-and-play model, with little friction. In this new paradigm, key services such as deposit-taking service, asset-custodian, insurance, lending services, risk management, and the offer of securities, etc. will be redistributed between different tech layers and service providers. New capabilities, such as smart contract audit or underwriting (for non-crypto assets) could also be created along the way.

Any potential bank-contenders must “grab a piece of land” during this re-distribution of power. Either way, regardless of what angle you look at it, banking seems will never be the same again–what a relief!

Genping Liu is a partner with Vertex Ventures Southeast Asia and India fund.

Genping Liu is a partner with Vertex Ventures Southeast Asia and India fund.

Vertex Ventures Southeast Asia and India is part of the Vertex global network of venture capital funds. Its global network also comprises affiliates in Silicon Valley, China, and Israel. A trusted partner to some of the world’s most innovative entrepreneurs, Vertex supports its portfolio companies with unmatched operating experience and deep access to the capital, talent, partners, and customers they need to build truly global businesses.

This article was first published on Linkedin. Follow Vertex Ventures SEA & India Linkedin page to be updated on the upcoming third and last post of this series on Future of Banking.

TechNode Global publishes contributions relevant to entrepreneurship and innovation. You may submit your own original or published contributions subject to editorial discretion.

The future of banking: Money redefined in a financialized world (part 1 of 3)

The future of banking: An open and programmable money infrastructure (part 2 of 3)