Small and medium enterprises (SMEs) form the backbone of any economy.

Supplying anything from your daily groceries to industrial materials for construction, SMEs are ever-present within our lives. This is especially true in Indonesia, where they are commonly referred to as “warungs.”

There are currently over 64 million SMEs in Indonesia, which jointly employ 117 million people (or 97 percent of the total workforce).

According to Bank Rakyat Indonesia (BRI), SMEs contribute 61 percent to Indonesia’s GDP.

As seen from the statistics above, it is clear SMEs play an important role in the Indonesian economy. Besides fuelling the economic growth of the archipelago, SMEs also act as an important social inclusion tool by creating jobs for millions.

Help needed

However, they are struggling due to the economic headwinds brought about by the pandemic.

A survey involving close to 200 thousand SMEs found 23 percent had experienced a decline in their business turnover, while 19 percent encountered obstacles in distribution and faced problems in securing working capital.

An Asian Development Bank (ADB) survey painted a similar situation, where 30 percent of the local SMEs had recorded a decline in domestic demand and 48 percent were temporarily closed.

While the government has earmarked IDR 185 trillion to initiatives supporting the recovery of SMEs, more needs to be done for the heavily hit sector to recover.

The need for loans and credit facilities has never been greater for SMEs in Indonesia.

Currently, only 20 percent of total bank loans are distributed to SMEs (despite them contributing 61 percent of the GDP). This disproportionate distribution of loans stuns the growth of these small businesses, hampering the overall growth of the economy.

While the government has pledged to increase this figure to more than 30 percent by 2024, short-term measures need to be implemented before more SMEs go under.

The solution

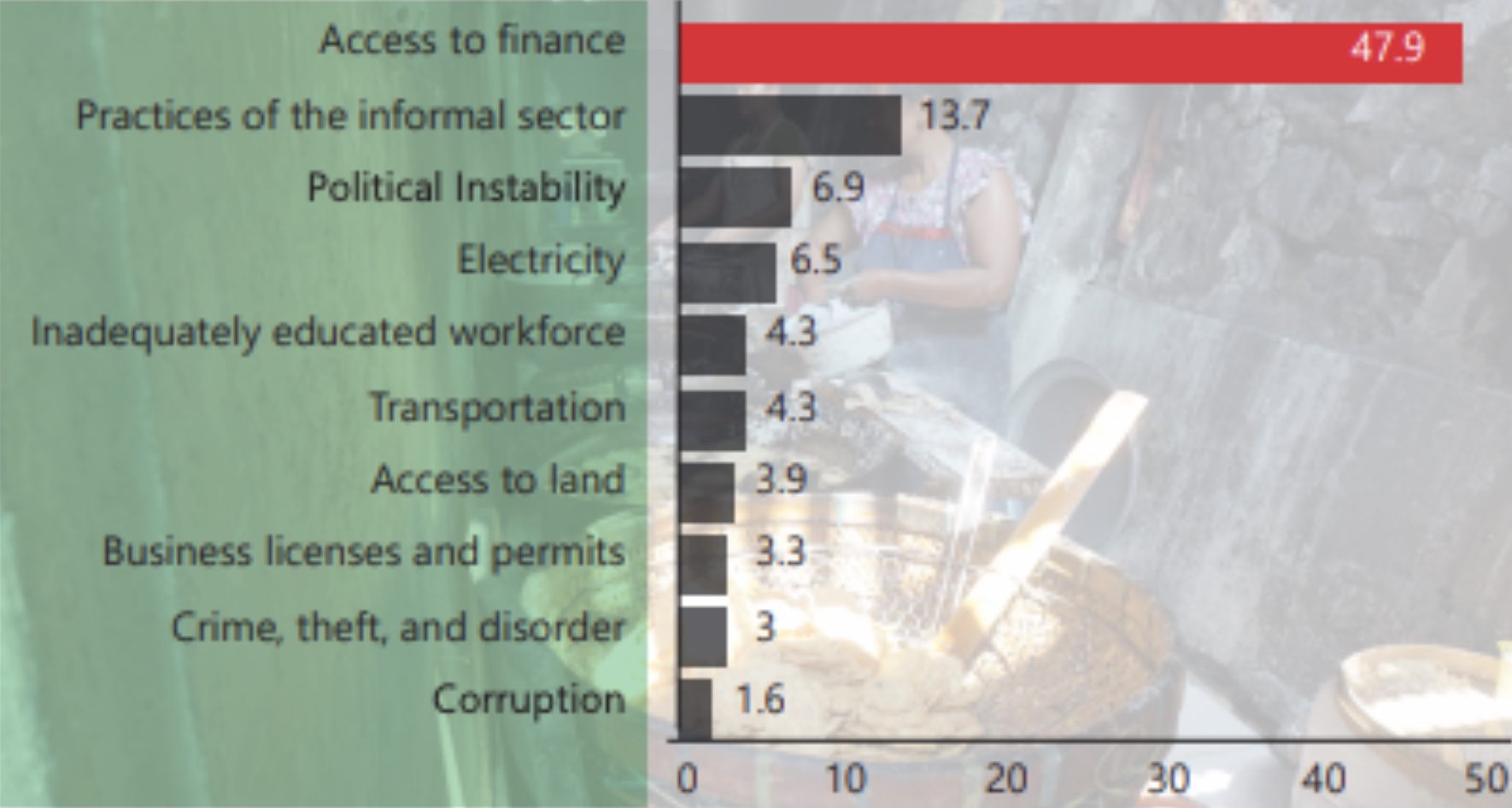

When one investigates the challenges behind SMEs’ lack of access to bank loans, the root cause is clear.

The lack of clarity over the financial position of the business and its owner hampers the bank’s ability to judge the ability to repay the loan. This creates a high-risk lending environment where it would be better off for the banks not to extend these loans.

Hence, solving this issue is relatively straightforward – provide banks with increased visibility of the financial health of SMEs and their owners to aid in their credit scoring and judgment.

The enabler for that to happen? Open Finance.

Defined as the consented exchange of financial data between financial institutions, Open Finance enables both incumbent financial institutions and fintech companies to access a wide range of consumer financial data across different platforms.

This enables companies to gain a better understanding of their users and provide more services for them.

With Open Finance, banks and lending platforms can credit score their lenders in a faster and more accurate manner. By accessing their cash flow statements, these lenders will have a clearer picture of an SME’s true ability to repay the loan.

Furthermore, they can analyze the financial and identity data of the SME owners to identify their financial position and identify potential collaterals to go along with the loan.

Solving the credit crunch

Crucially, this opens up more sources of credit for SMEs to alleviate their financial difficulties.

Businesses previously denied loans due to the lack of credit history would be more likely to be offered a loan given the increased clarity lenders have over their financial position.

For example, a warung selling sarongs would previously be denied a business loan as banks did not have a clear picture of its revenue and cash flows.

However, with Open Finance and open APIs facilitating the exchange of data from the warung’s e-wallet provider, banks will now be able to analyze their cash flow and transactions.

Upon discovering the warung has a strong source of recurring revenue, the bank would be able to offer it the loan and at more favorable terms too.

Importance

The struggles of SMEs in Indonesia have been well documented. Alongside the government’s stimulus package to support these businesses, it is important for other financial institutions including banks and P2P lending platforms to provide credit.

Given the substantial impact SMEs have on both the workforce and the economy, we cannot afford to let more of these businesses go under. More could lose their livelihoods and plunge into poverty, creating a host of additional social issues for the government to tackle.

Therefore, financial institutions and regulators need to embrace Open Finance as a means to solving this pressing issue.

Finantier is the enabler for Open Finance in Indonesia. We work with companies to provide access to data from a wide range of financial platforms within the country, unlocking new groups of customers for them.

Besides, the access to data also enables the creation of more innovative and personalized products, potentially opening up a new revenue stream for these companies.

Speak to us today to learn more about how we can help you. Together, let us provide a better environment for SMEs to grow in, enabling the Indonesian economy to prosper.

In summary

- SMEs in Indonesia are facing a credit crunch due to the lack of access to loans.

- Open Finance solves this problem by allowing financial institutions to better determine the ability of SMEs to repay.

- This enables more SMEs to access loans and avoid shutting down, preventing massive job losses and social problems.

Tun Yong Yap is part of the Growth & Strategy team at Finantier, an Open Finance API platform that provides infrastructure and data products to power the next generation of financial services in SEA.

TechNode Global publishes contributions relevant to entrepreneurship and innovation. You may submit your own original or published contributions subject to editorial discretion.

FinTech startup Finantier joins Y Combinator’s Winter 2021 batch, will expand its tech team

Featured image credits: Unsplash