Venture Capital

News,Venture Capital,Malaysia,Private Equity

Malaysia will increase capital flow to innovative start-ups in high value-add sectors

The Securities Commission Malaysia (SC) said Monday that it will increase the flow of capital to innovative start-ups in high value-add sectors such as electrical and electronics, data infrastructure and medical devices.

March 9, 2026

News,Venture Capital,Malaysia,Private Equity

Malaysia’s venture capital and private equity record 21% CAGR between 2020 and 2025

Despite global fundraising headwinds, Malaysia’s venture capital (VC) and private equity (PE) segments grew at a rapid pace, with total cumulative VC/PE committed funds under management recording a 21 percent compound annual growth rate (CAGR) between 2020 and 2025, the Securities Commission Malaysia (SC) said Monday.

March 9, 2026

Vietnam’s Ho Chi Minh City to establish $191M VC Fund

Authorities in Vietnam's Ho Chi Minh City have approved a plan to establish a venture capital (VC) fund aimed at boosting technology startups, commercializing research, and accelerating innovation in key strategic industries.

March 6, 2026

Biotech / MedTech,News,Investments,Venture Capital,Malaysia

Gobi Partners invests in Cortical Labs, expands biological computing hub

Asia-focused venture capital firm Gobi Partners has invested in Cortical Labs, a biotechnology company developing computing systems that combine living human neurons with silicon hardware.

March 4, 2026

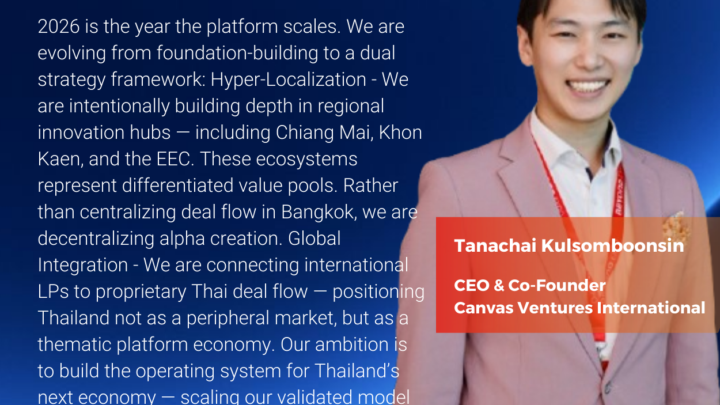

Venture Capital,Year in Review,Thailand,Features

Canvas Ventures International aims to build operating system for Thailand’s Next Economy [Q&A]

We talked to Tanachai Kulsomboonsin, CEO and Co-founder at Canvas Ventures International, to learn more about the VC firm’s achievements in 2025 and its plans and aspirations for 2026. He also shared his views on the outlook of tech ecosystem in Thailand for 2026.

March 3, 2026

Peak XV announces $1.3B across three new funds for exceptional founders in India, APAC and beyond

Peak XV has announced the closing of $1.3 billion in new capital commitments across its India Seed, India Venture, and APAC funds.

February 24, 2026

Investments,TNGlobal Q&A and Interviews,Malaysia,Venture Capital,Features

Malaysia’s Vynn Capital eyes 2026 with cautious optimism [Q&A]

We talked to Victor Chua, Founding and Managing Partner at Vynn Capital, to learn more about the VC firm’s achievements in 2025 and its plans and aspirations for 2026. He also shared his views on the outlook of tech ecosystem in Malaysia and Southeast Asia for 2026.

February 23, 2026

Khazanah’s Jelawang Capital backs more than ten startups with over $7.64M capital

Malaysia's state-owned fund Khazanah Nasional Berhad said Tuesday that through Jelawang Capital, Malaysia’s National Fund of Funds, its first five fund managers have backed more than ten startups and catalyzed over MYR 30 million ($7.64 million) in crowded-in capital.

February 10, 2026

News,Singapore,Venture Capital

Microsoft launches AI QuickStart Program in Singapore with support from IMDA and UOB

Global technology firm Microsoft has launched the AI QuickStart program, a new initiative to help digitally mature enterprises – including small and medium-sized enterprises (SMEs) as well as large enterprises – known as Digital Leaders to rapidly deploy practical, enterprise-ready artificial intelligence (AI) solutions in Singapore.

February 9, 2026

Features,Singapore,Asia,Venture Capital,TNGlobal Q&A and Interviews,Year in Review,SEA,Indonesia

East Ventures stays “cautiously optimistic” on Southeast Asia tech ecosystem in 2026

We talked to Roderick Purwana, Managing Partner at East Ventures to learn more about the firm’s development in 2025 and its plans and aspirations for 2026. He also shared his views on the outlook of tech ecosystem in Southeast Asia in 2026.

February 9, 2026