FinTech

Indonesia’s Hijra Bank optimistic on this year performance, aiming 1M users in 2024

Indonesian Islamic digital bank Hijra Bank is optimistic that its performance this year will increase, because it is supported by the number of users that have experienced significant growth, in line with the high public needs in sharia financial services.

March 16, 2023

Visa partners GHL to offer consumers instalment options for in-store purchases in Malaysia

Global digital payments firm Visa has announced its partnership with Malaysia-based payments company GHL Systems Berhad to enable Visa Instalments for in-store purchases, a first of its kind initiative in Asia Pacific.

March 10, 2023

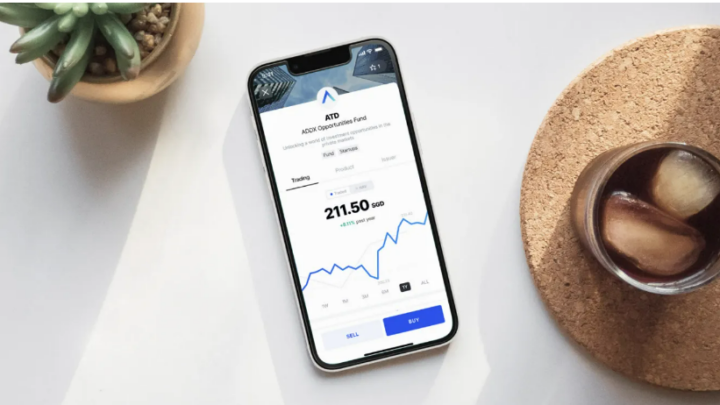

Yangzijiang Financial works with ADDX on capital markets products distribution

Singapore private market exchange ADDX has inked a memorandum of understanding (MOU) with Singapore-listed financial firm Yangzijiang Financial Holding Ltd for the distribution of capital markets products.

March 10, 2023

India’s Growfin raises $7.5M Series A funding led by SWC Global

Indian fintech startup Growfin has on Tuesday announced a $7.5 million Series A funding round to provide real-time visibility and predictability in cash flow for modern Chief Financial Officers (CFOs).

March 7, 2023

News,SEA,eCommerce,Transportation,Singapore,FinTech

Grab retires $600M in 2026 debt with extra cash – report

The Singapore-based ride-hailing and delivery company completed the transaction last week, bringing its debt under an outstanding term loan to $517 million, down from the previous balance of $1.117 billion. Grab also has about $200 million in other bank debt.

March 7, 2023

Singapore’s Endowus launches community impact initiative

Endowus, a Singapore-based digital wealth platform, has launched a community impact initiative, Endowus Empower. This initiative aims to provide underrepresented, underserved, and underprivileged groups with the right tools, advice, opportunities, and community support to reach their wealth and life goals.

March 7, 2023

TNGlobal Insider,Opinion,FinTech

Creating a more equitable financial system with inclusive fintech

Inclusive fintech has the potential to revolutionize the financial industry and create a more equitable and just financial system for all. By using technology to provide financial services to underserved and unbanked populations, we can help break down barriers and promote financial inclusion for all.

March 6, 2023

FOMO Pay has officially become the member of Singapore Clearing House Association (SCHA)

FOMO Pay, a Singapore-based major payment institution, has on Monday announced its official membership in the Singapore Clearing House Association (SCHA), a prestigious organization comprising the Monetary Authority of Singapore (MAS) and elected financial institutions.

March 6, 2023

Singapore’s iLex closes $4.5M Pre-Series A round led by QBN Capital

ILex, a Singapore-based market infrastructure provider for syndicated loan and private debt markets, has on Thursday announced it has raised $4.5 million in new capital. The round was led by QBN Capital, with participation from existing and new investors.

March 2, 2023

News,SEA,eCommerce,Transportation,Singapore,FinTech

Grab has liquidity to drive operations, says S&P Global Ratings

The stable rating outlook on Grab reflects S&P Global Ratings' view that the company will maintain sufficient liquidity to tide it through until it reaches positive EBITDA and cash flow by 2025.

February 28, 2023

Insurer FWD makes debut on Hong Kong bourse

July 7, 2025

Insurer FWD makes debut on Hong Kong bourse

July 7, 2025