Editor’s note: This article is written in partnership with Ant International.

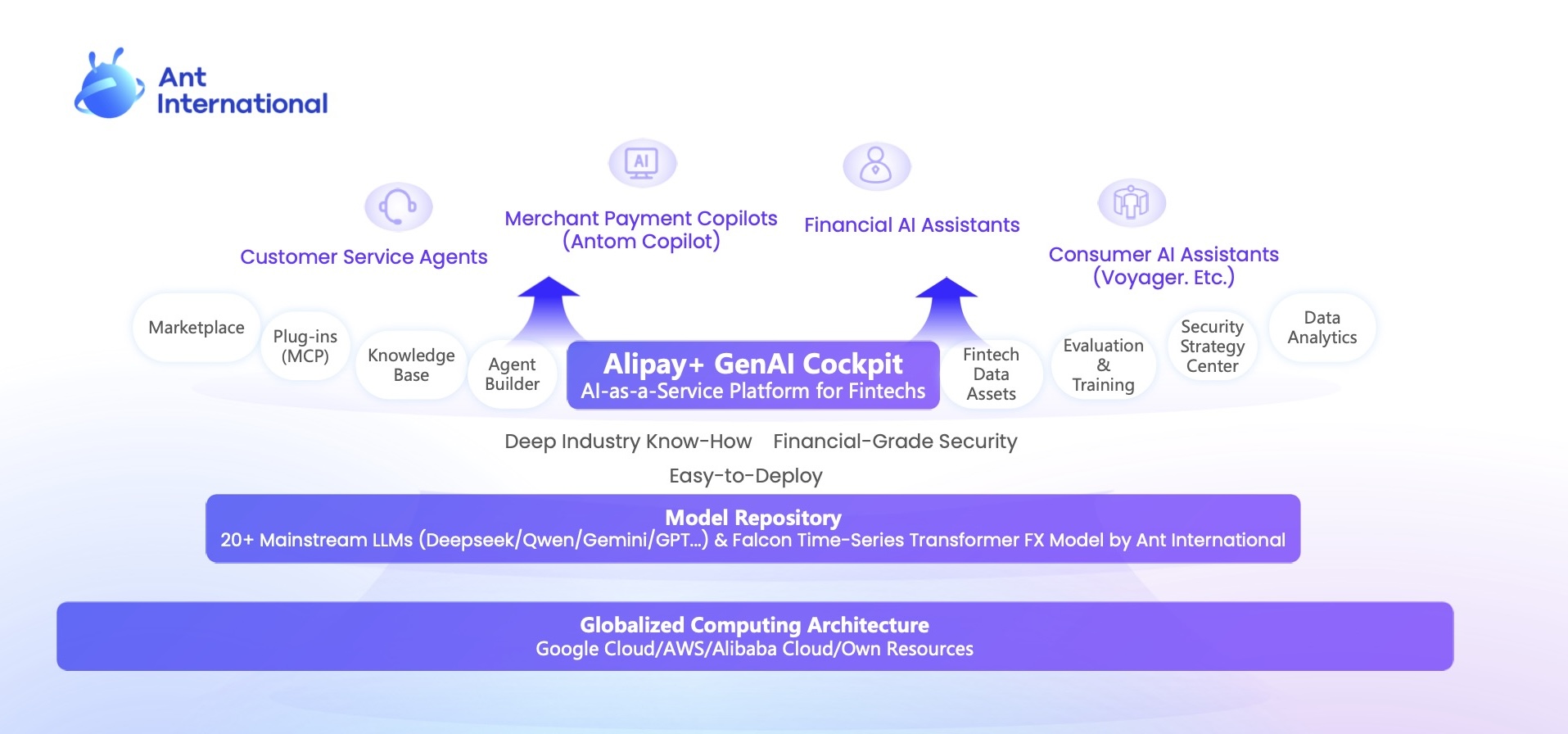

Ant International, a Singapore-headquartered global digital payment and financial technology provider, has recently unveiled its AI strategy with the launch of Alipay+ GenAI Cockpit, an AI-as-a-Service (AIaaS) platform that empowers fintech companies and super apps to build AI-agentic and ultimately AI-native financial services with enhanced efficiency, security, and flexibility.

Making AI systemically work for finance remains the holy grail of the current AI revolution. Alipay+ GenAI Cockpit is a platform to help entrepreneurs architect an agentic and ultimately AI-native financial services, combining automated workflows and task orchestration with a dynamic enterprise context, across main fintech tasks, from payment orchestration, customer onboarding, compliance checks, to fraud detection, dispute resolution, as well as evaluation and performance optimization, the company said in a statement last month.

TNGlobal recently talked to Jiangming Yang, Chief Innovation Officer of Ant International, to learn more about the company’s AI strategy, how it can help to empower small and medium enterprises (SMEs), and the markets the company is looking at.

“If we can remove the boundary of cross-border money movement and global payments as well as the boundary of digitalization, we can make it easier for SMEs, merchants, to do global payments,” he said in the interview.

“They [SMEs] can then have the same accessibility that any chartered accountant has. That will eventually empower all the global and local economies. I think that is the mission and the direction we are trying to solve. Antom, Alipay+, WorldFirst are all aligned with this direction,” he added.

In the interview, Yang also explained the challenges fintech companies are facing including the use of deepfakes and how Ant International is tackling these risks and challenges with its technology.

Below are the edited excerpts:

Below are the edited excerpts:

Could you please briefly tell us the businesses Ant International is involved in? Where do you see opportunities?

There are four pillars of business in Ant International, and our mission is really to make it easy to do business anywhere.

Our first pillar is Antom, which provides payment and digitisation services for businesses, regardless of whether they are a big merchant or an SME. We hope to ultimately remove all barriers when it comes to payments across borders.

The second pillar is Alipay+. It’s the global cross-border digital gateway that enables merchants to accept payments from our various partner e-wallets, simultaneously making it easy for travellers to pay in their home currency while abroad while also allowing merchants to easily accept payments from tourists.

The third one is WorldFirst, a multi-currency account, that enables SMEs to trade globally. With WorldFirst, SMEs can pay and get paid and manage their global earnings on one platform.

Last but not least is our Embedded Finance pillar, which includes our digital lending service Bettr. Under this pillar, we are providing technology-driven credit services, liquidity solutions and FX solutions to our customers.

Many financial services in the industry are still tailored towards larger institutions than smaller businesses. Ant International don’t just serve big companies. In fact, we focus largely on SMEs – they make up 90 percent of businesses in the world.

I think there are several reasons that explain this. One is that SMEs tend to have more diverse and less predictable financial profiles, which can make it more complex to serve them at scale, and secondly small businesses can incur higher operational cost. To support SMEs, you need to have high operational efficiency to lower operational cost to help SMEs manage the business.

Amid this, there is now a tech evolution of AI – specifically the large language model. Similar to past tech evolutions, oftentimes such technology will boost efficiency of the industry very significantly. That is when the technology has a huge breakthrough.

Similarly, in the fintech industry, when we see the growth of AI, of large language models, we’ll see if we can tap on this technology to improve on the whole merchant journey: from the time they do the onboarding, the integration, the KYC (know-your-customer), to the time they process the payment or when they need to manage customer disputes.

If AI can support 80 percent or 90 percent of the services I just mentioned, potentially, we can boost the efficiency of how we serve our customers multifold.

We see the huge opportunity that AI can bring big changes to the payments industry. We all know that SMEs make up a large majority of businesses globally. This will change how payments companies or fintech companies eventually offer solutions in previously untapped markets and customers.

The second part is the consumer side. When people have some savings, we often ask ourselves: How do we make investments? How do we do wealth management? What insurance product should we purchase for our families? That’s a very common request from consumers.

Oftentimes, hiring financial experts or advisors can be costly. There is limited expertise providing the services, and the demand outstrips supply.

With the large language model, things can be much more scalable. Perhaps not to 100 percent, but if we can input 70 to 80 percent of key knowledge into the product through a large language model that will help us provide insurance or wealth management advice, this will change the industry. We can make this more inclusive, so that more users can enjoy these services. That is the power we see through this AI transformation.

When we experiment with new technologies like AI, we first apply it to our internal products. Such a step is very important as it builds trust from our partners, to show them that we’ve built something that we believe in and are so confident about that we are using it in our own services. The idea is that we want to prove that it works, and then we can roll out these capabilities to our partners.

That’s what we have done with Alipay+ GenAI Cockpit – a platform which allows merchants to build, customise and integrate AI agents into their services. We’ve already begun integrating this product with some of our wallet partners.

One example is our agentic AI product Antom Copilot. Antom offers merchant-facing payment and digitisation services, and Antom Copilot is our AI product which supports the merchant through any questions that it might have about Antom’s payment services. A recent feature we launched is the AI-powered chargeback tool, which helps merchants navigate the lengthy process for chargeback claims via AI.

The second one is Alipay+ Voyager, an AI travel companion that can be embedded within partner e-wallets and superapps. The Voyager agentic AI is able to support users with their travel needs before, during and after their trip, with personalised recommendations from our OTA partners and Alipay+’s 100 million offline merchants through one single interface.

What we believe is that AI technology shouldn’t just belong to big companies. We want to create an effective ecosystem that can empower all our partners.

You mentioned about SMEs, I think we are particularly interested in that. Which are the regions or countries that Ant is already providing such solutions for SMEs?

Currently, Southeast Asia is one of our key markets. We work with our local partners to provide fintech services to these regions. Some examples of countries we offer services to include the Philippines, Thailand, Malaysia and Singapore.

We already serve thousands of SMEs in this region but the market is huge – we are only at the beginning of our journey.

Can you share what are the competitive advantages of the Alipay+ Gen AI Cockpit platform as compared to other similar platforms. How do you differentiate yourself?

When it comes to integrating AI models into the finance industry, there are some specific requirements, primarily because the finance industry comes with a lot of regulations and compliance that needs to be embedded into the AI models.

Since we are a leading fintech company, this means that we also possess deep expertise in the finance industry in various markets. Such knowledge can then be pre-loaded into the AI agents in the Cockpit platform, which SMEs can then integrate and deploy in their services.

Another advantage of Cockpit is that the AI agents are customisable and modular – this means that SMEs hoping to include AI-driven technology into their services do not need to build it from scratch, while larger companies who require more customisable solutions can tailor-make an AI-agent that specifically meets their workflow.

You mentioned that the Cockpit platform offers pre-built customizable agents for features like customer service, tax refunds and cross-border remittances. Can you provide a concrete example on how this can be done?

Imagine I’m a jewellery designer in Singapore. I want to open my own online shop, and share my products with customers globally. Since I’m very good at designing products, I can make my website look fancy, beautiful, and attractive to customers.

But as a small business, it’s very unlikely that I can hire a payments engineer to build a payment solution for me. I probably don’t have extensive knowledge about what the fee structure for Visa or Mastercard is. So, when I receive a dispute, I may not have the expertise to help me manage this dispute or even know how to respond to it. Or perhaps, if my transaction amount doesn’t match what I received in my bank amount, how do I do the reconciliation?

Small businesses may not necessarily be extremely knowledgeable about these issues, and therefore payments becomes a sort of barrier, an obstacle of sorts when it comes to operating a business. Since payment-related matters require lots of domain knowledge, typically larger companies are the ones who can afford to have a large team to help manage all the complexities.

Nowadays, we can make this much more accessible through AI. You can give a description of your website, and our AI will be able to generate the integration code for you. Simply click and it will run. You don’t need to have the expertise to deal with all the complexities. You can just send the request to AI.

So you can say, “I have a dispute; this is my situation, please help me handle this.” And AI will generate the responses for you. They have knowledge about disputes, knowledge about the rules of chargeback. They have the knowledge on what evidence you need to provide in order to win the dispute, and they will ask you for the information. Then, they will do the preparation for you. AI will remove these barriers and make payments easier to deal with and more accessible for many users.

What other pain points do you think this platform can address?

Another potential pain point that Cockpit can help address is Know-Your-Customer (KYC), which is an important compliance regulation where finance institutions need to verify the identity of their clients and evaluate the risks that the client may pose.

KYC is the foundation for everything in finance, to prevent fraud, money-laundering, and so forth. When you sign up for financial services, there is always a verification process, be it via document checks or facial recognition. But with AI today, such KYC technologies are facing challenges.

With the rise of deepfakes, deepfake fraud has become a huge risk in the finance industry. As deepfake technology becomes increasingly sophisticated and realistic this means that we cannot necessarily rely on humans to check for such fraud.

This is because deepfake technology today can easily generate a realistic image of a person, and even an ID. Deepfakes today can even bypass some facial recognition liveness checks, as the technology can generate the image of a person who can turn left and right.

So, as a fintech company, we have to build capabilities to detect deepfakes and prevent such fraud. I think that’s key for all fintech companies.

Earlier last year, we received such an attack on our system. At its peak, 70 percent of the KYC requests in our system were comprised of deepfakes.

Currently, the way to use deepfakes has a very low barrier since all the code is open-source. Even a high school student can run a project by themselves. This makes deepfakes a real threat. Fortunately, our system was able to identify and intercept them effectively.

Historically, previous machine learning KYC technologies were not that accurate. When the machine learning model is not able to determine a KYC case, that is when human expertise is required to review it and make a decision. But with realistic deepfakes, human expertise is no longer effective, since they may not be able to tell the difference between a fake ID and a real ID.

When such traditional methodologies stop working, you have to build another AI to detect whether an image is AI-generated or not. For us, we have built an anti-deepfake KYC tool that has an interception success rate of over 99 percent. This technology is also embedded in our AI agents on the Cockpit platform. Since not all SMEs can come up with the same defense capabilities, we hope to support our partners with our solutions so that SMEs can also protect themselves against these growing threats.

Moving into the future, as a Chief Innovation Officer, what excites you the most about the future of AI in financial services? What is the ultimate vision Ant International is looking into to achieve through all these AI initiatives?

Like our vision states, we want to make it easy to do business anywhere. With our AI initiatives we hope to really lower the barrier of entry for SMEs to do business globally without worrying about cross-border payments and transactions.

Once these barriers are removed, there is so much more potential for SMEs to reach a broader customer base rather than be confined to a local market. I believe SMEs will then truly be able to drive not just their local economies but also the broader global economy.

AI, as a game-changing technology, will be instrumental in driving such progress within the fintech industry.

Ant International pushes AI strategy with AI platform for Fintechs