InsurTech

Singapore’s Foundation Healthcare enters Hong Kong in partnership with FWD

Singapore-based healthcare group Foundation Healthcare Holdings Pte. Ltd. (FHH) has announced that it has entered the Hong Kong market with the implementation of Smarter Health Pte. Ltd. (SH)’s digital pre-authorization platform, launched in partnership with FWD Hong Kong.

May 22, 2023

Singapore’s bolttech raises $196M Series B funding with an up-round valuation of $1.6B

Singapore-based insurtech firm bolttech has on Wednesday announced it has raised $196 million in connection with its Series B with an up-round valuation of $1.6 billion. The round was led by Japanese insurance firm Tokio Marine.

May 18, 2023

Tokio Marine, Finology, KirimMan partner to offer insurance to gig economy workers in Malaysia

Tokio Marine Insurans (Malaysia) Berhad (Tokio Marine), a subsidiary of Japan-based insurance firm Tokio Marine Holdings Inc., has partnered with Malaysia-based logistic solution KirimMan and Malaysia-based fintech company Finology, to offer affordable insurance products for gig economy workers in Malaysia, with a focus on delivery riders.

April 18, 2023

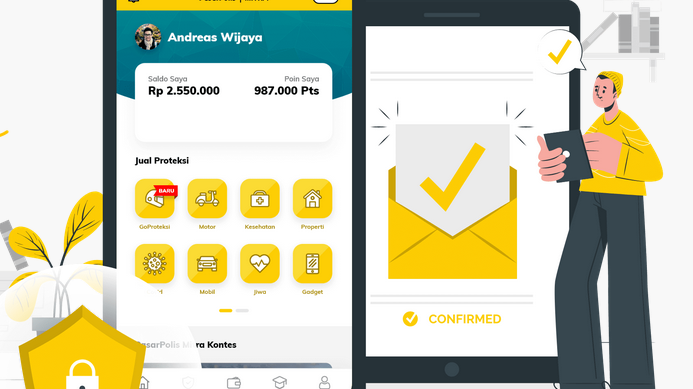

Indonesian insurtech firm PasarPolis sees significant growth potential in Indonesia

With less than two percent insurance penetration, Indonesia presents a market with significant headroom for growth, Indonesia-based insurtech firm Pasar Polis said Monday.

April 10, 2023

Singapore’s Igloo extends weather index insurance to coffee farmers in Vietnam

Following the success of the weather index insurance for rice farmers, Singapore-based insurtech Igloo expands its blockchain-based parametric index insurance to coffee farmers.

March 30, 2023

Thai insurtech Roojai raises $42M Series B funding led by HDI International

Roojai, a Thai-based online business to consumer (B2C) insurtech, has announced a $42 million Series B funding round led by HDI International, the international retail insurance division of the German Talanx Group.

March 28, 2023

FWD to enter Malaysian life insurance market with strategic investment in Gibraltar BSN

Hong Kong-based insurance firm FWD Group Holdings Limited will enter the Malaysian life insurance market following the signing of an agreement to invest in a majority stake in Gibraltar BSN Life Berhad (Gibraltar BSN).

February 20, 2023

Thai insurtech startup Eazy Digital raises $850,000 in oversubscribed seed round

Eazy Digital, a Thai insurtech startup that provides digital platforms for insurance companies, has raised $850,000 in an oversubscribed seed funding round. The round was led by Wavemaker Partners, with participation from Seedstars International Ventures, Wing Vasiksiri, and Sasin Bangkok Venture Club.

January 30, 2023

PasarPolis becomes Indonesia’s first full-stack insurtech ecosystem with new strategic partnership

PasarPolis, an Indonesia-based insurtech firm, has become Indonesia's first official full-stack insurtech ecosystem, giving the company the ability to both distribute and underwrite its own digital insurance products.

January 12, 2023

News,Thailand,Singapore,InsurTech

Bolttech partners AIS for embedded protection services in Thailand

Singapore-based insurtech bolttech, has partnered with Thailand’s mobile network operator AIS, to deliver embedded protection services including mobile device switch and replacement services to AIS customers for the recently-launched AIS Care+ programme.

January 10, 2023