FinTech

News,SEA,Singapore,FinTech,Transportation

Grab’s 3Q revenue down 9% due to coronavirus curbs, net loss widen to $988M

Mobility and food delivery services were suspended in Vietnam for most of Q3, and six of its core countries in which Grab operates experienced tighter movement controls.

November 12, 2021

Southeast Asia FinTech fundraising hits record high of $3.5B year to date – report

Following a dip in fundraising seen across ASEAN’s FinTech scene in 2020, funding has rebounded to reach a record high of $3.5 billion year to date, more than triple the amount seen over 2020, said an industry report. This funding was driven by 13 mega-rounds (classified as funding rounds of at least US$100 million), accounting for more than half of total…

November 11, 2021

Airwallex secures payment license in Singapore, set to launch payment services in Singapore next year

Airwallex, a global fintech platform, announced Monday that its Singapore entity Airwallex (Singapore) Pte Ltd, has been granted a Major Payment Institution License by the Monetary Authority of Singapore (MAS) under the Payment Services Act.

November 9, 2021

Mastercard partners with Asian digital currency firms to launch first Crypto-linked payment cards in Asia Pacific

Mastercard has partnered with three Asia Pacific (APAC) cryptocurrency service providers Amber Group (Hong Kong), Bitkub (Thailand) and CoinJar (Australia) to launch crypto-funded Mastercard payment cards. Consumers and businesses in the APAC region will be able to apply for crypto-linked Mastercard credit, debit or pre-paid cards that will enable them to…

November 9, 2021

News,Singapore,eCommerce,Mergers and Acquisitions,FinTech

Singapore shopping and rewards platform ShopBack to acquire BNPL player hoolah

hoolah will accelerate its growth with a platform to extend its BNPL offering to over 8,000 merchants and 30 million shoppers across nine markets in the Asia-Pacific. ShopBack will further enhance its suite of shopping tools and rewards by offering shoppers a responsible, convenient, and flexible payment option at checkout.

November 2, 2021

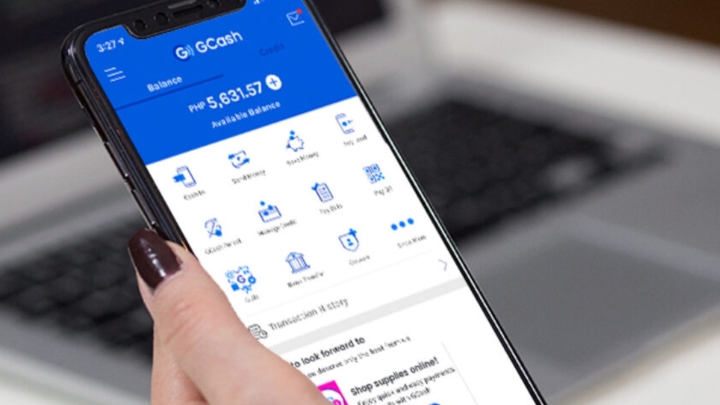

News,Philippines,FinTech,Investments

Mynt secures $300M funding from lead investors Warburg Pincus, Insight Partners and Bow Wave, now valued at over $2B

Since the onset of community quarantines as a response to COVID-19, Mynt has been at the forefront of the digital transformation of Filipinos as the 'go-to' payment and financial services solution to over 48 million users, nearly half of the national population. With the continued relevance of the app among its users, Mynt is on track to reach PHP 3…

November 2, 2021

ShopeePay partners Malaysia’s GHL to expand its digital payments in the Philippines

ShopeePay e-wallet users will now be able to pay at establishments such as Phoenix Petroleum, Family Mart, Three Sixty Pharmacy, Prince Retail, and more chains nationwide.

October 29, 2021

News,FinTech,Singapore,Mergers and Acquisitions

Validus acquires KlearCard’s business payments and expense management platform to bolster its upcoming SME Neobank offering

The acquisition of the KlearCard platform, an established player with a proven product-market fit in the region, will pave the way for Validus to accelerate its build-out of Southeast Asia’s first credit-led SME-focused Neobank, which will provide SMEs with a best-in-class experience through a fully integrated and holistic suite of financial tools and…

October 29, 2021

India neobank Zolve closes $40M Series A funding round at a valuation of $210M, will scale financial services for US-bound immgrants

With these additional funds, Zolve intends to enhance the user experience for global citizens, allowing them to open their U.S. accounts in minutes. Moreover, the funds will help speed expansion of the service to more nationalities, increasing the number of people who can start building their financial futures from the moment they arrive in the U.S.…

October 28, 2021

FinTech,TNGlobal Q&A and Interviews,Malaysia

Angkasa-Boustead consortium banks on Islamic bank positioning, existing captive members to win a digital banking license in Malaysia [Q&A]

In the interview, Hudhaifa shared the opportunities the consortium sees in building a digital bank in Malaysia and what are the competitive advantages it has against other contenders vying for the digital banking licenses. He also shared his views on the profitability path for digital banks, citing examples from other countries.

October 27, 2021