This is the second article of a series on the future of banking by Genping Liu, Partner at Vertex Ventures Southeast Asia and India fund.

Earlier, in part 1 of this 3-part series published two weeks ago., I discussed the trend of money being reimagined in an increasingly financialized world. Building upon that, I am highlighting another trend.

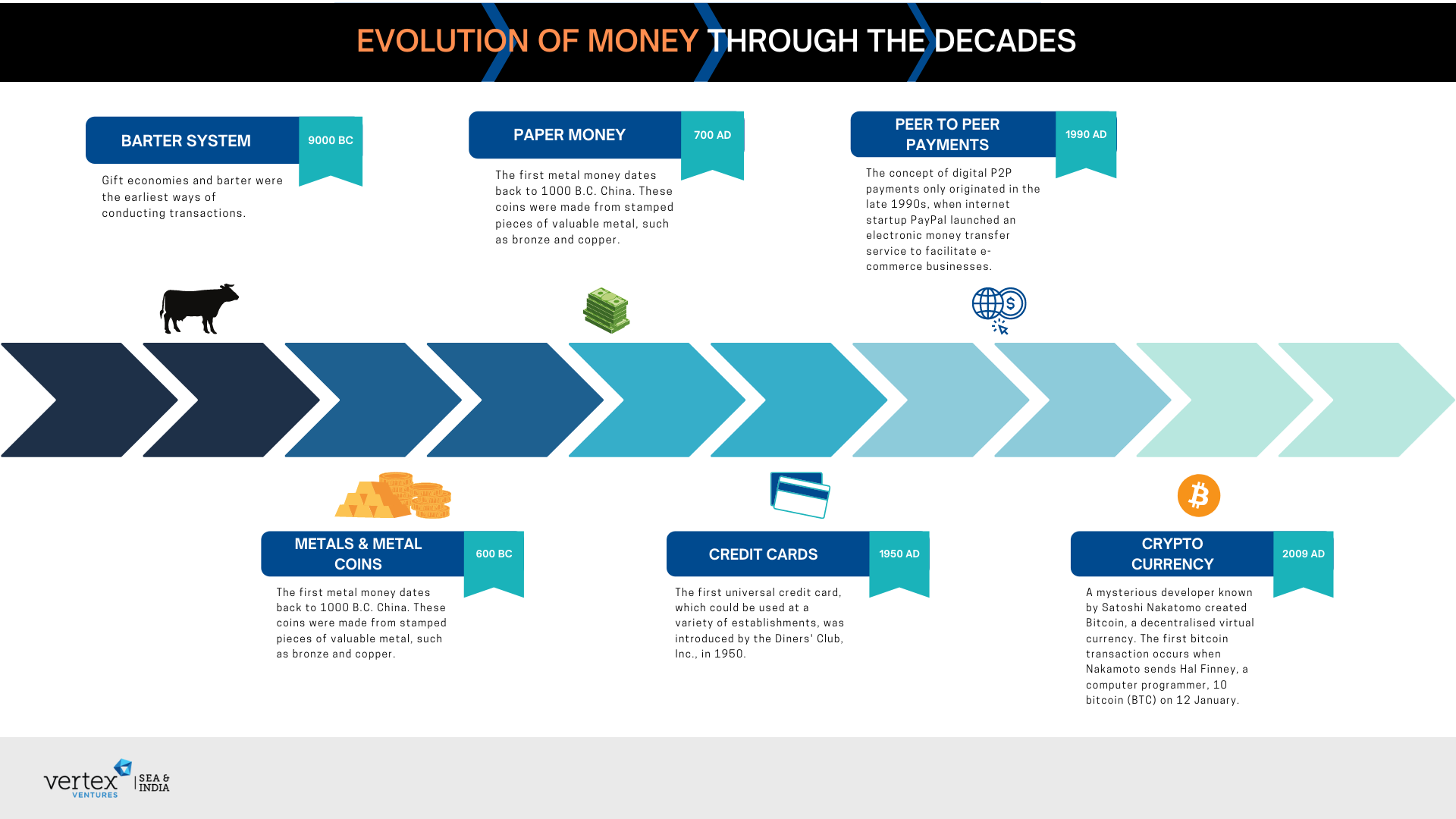

How the concept of money has evolved through the decades

To provide context, the money I grew up with, was paper fiat money. Then, it became a printed number on the checkbook, and cash is what you withdraw from the bank when you need it. Soon, it became even more digitized, allowing it to cross between banks, then industries, and finally, across countries.

Nonetheless, the management of money still generally involves lots of human intervention, heavy processes, and a large IT system that combines legacy and modern software painfully pieced together. And, despite being digital, it still remains rather rigid, held back by systems and regulations that carry a lot of legacies over the last few decades.

Now, startups are finding more innovative ways to make money more programmable

Payment tech leader, Stripe, and its rapid adoption, is showing us the importance of having a “developer-first programmability” to manage the money flow; while Plaid is showing us that we need “programmability around banking access” to increase data flow.

What I think is remarkable about Stripe and Plaid is that even though they are building within the constraints of banks and regulations that are moving at a snail pace, their progress has been relatively fast-paced. We can only imagine how much value can be created if a lot of constraints around banking are removed.

Nevertheless, regulators are catching up with speed. Seeing the potential of a more open flow of payment and data, many regulators started to move fast in recent years.

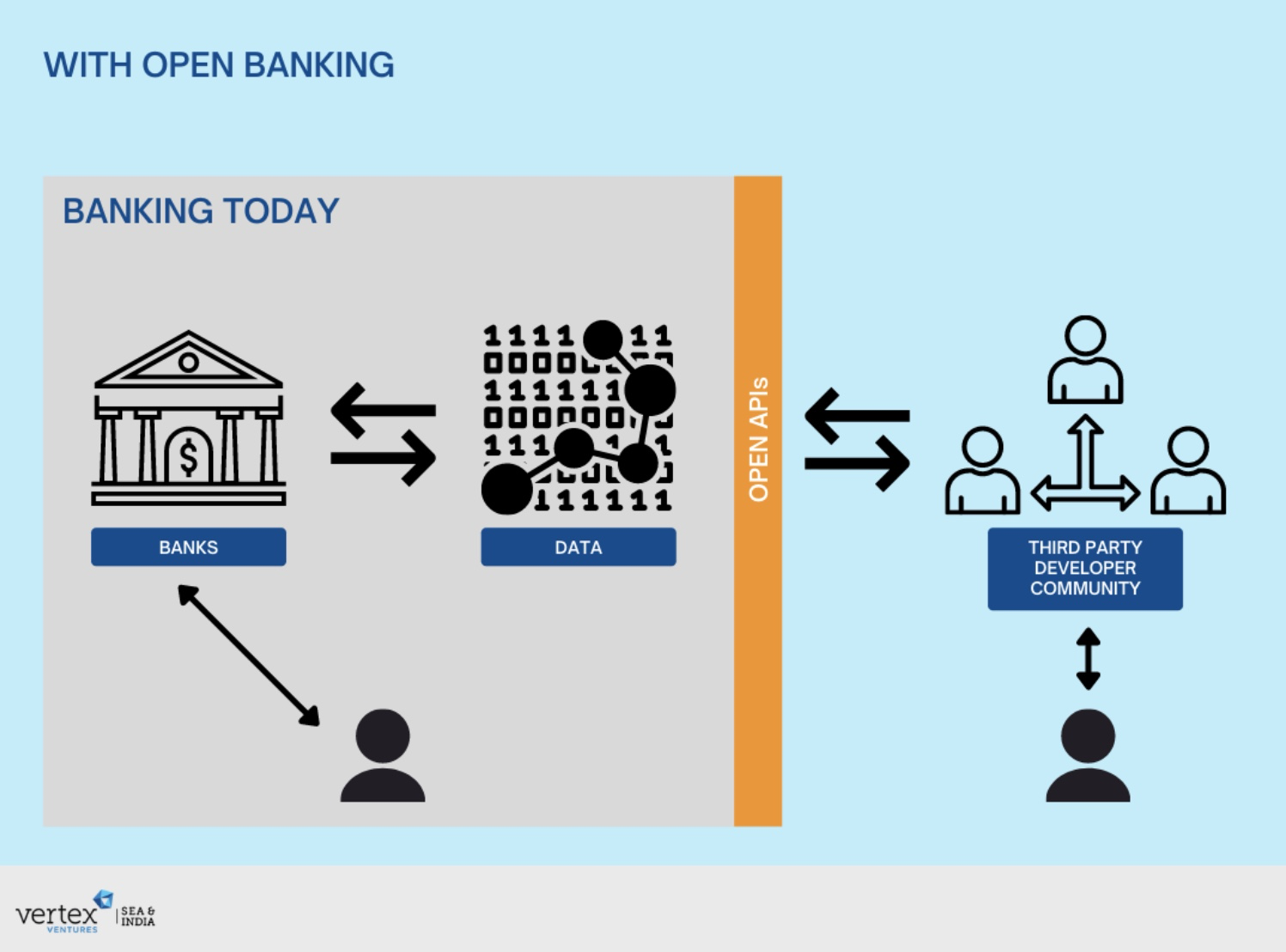

Dawn of Open banking

Europe has mandated the open banking regulation, while India has taken a dramatic move to build the open payment rail and account data aggregation capabilities. With this, banks that used to treat clients’ data as their moat and now are being forced to open up to give the rights back to their clients. Along with the shifts of the rights of payment movement and data ownership, capabilities to make money more programmable at the bank account level through open APIs are being built too.

The banking business is no longer limited to banks and financial institutions as well. In the US, a startup Reserve Trust, has directly integrated with the Federal Reserve master account.

What have we seen thus far, apart from Open banking?

Banking as a service, embedded finance, and Neo-tech Brands

I’m seeing a rapidly developing API stack, emerging Banking as a Service (BAAS) players, and the proliferation of a new generation of embedded finance companies. Many players can now easily integrate fintech capabilities, and even ride on partner banks’ licenses to launch Neo-tech bank brands. Old money is opening up and breaking into the tech world.

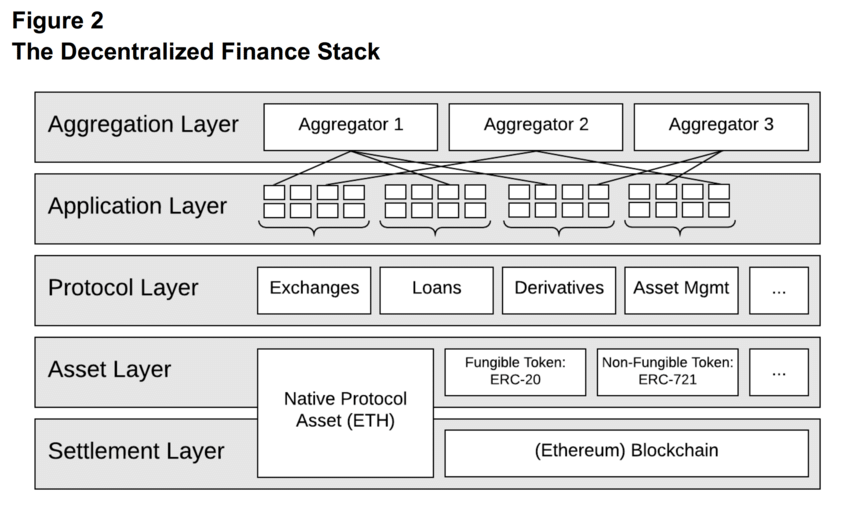

Then there’s Programmable money

On the other side of the tech landscape, Bitcoin, along with another crypto, bring potential disruptions to the market as they are open and programmable by nature, and dearly loved by the tech world. Built upon the ‘trustless machine’ thesis, they are being adopted rapidly by various communities. They sit on the opposite side of the banking system because it is where the whole infrastructure is open and without any intermediaries.

You can build on the platform directly, or an API/ service for others without much restriction. This openness and programmability of tech are what every tech builder has once dreamed of.

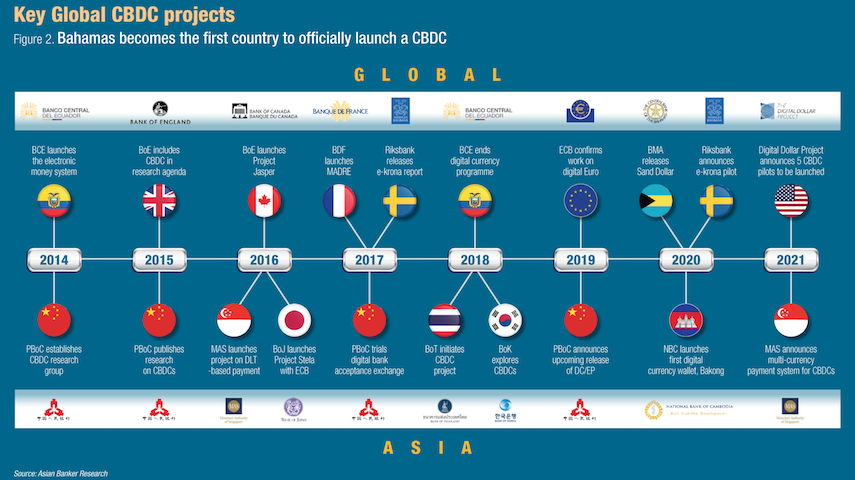

Followed by Central Bank Digital Currency (CBDC)

Next, you have the Central Bank Digital Currency (CBDC) following closely behind. While they may not be ‘crypto’ per se, many of its underlying principles are borrowed from the crypto world: CBDC is generally open (though there will be a designed-in feature to allow the central bank to manage) and programmable.

This twin combination of tech openness and strong governmental backing will surely challenge much of our traditional thinking about money and banking. It will also pose a threat to commercial banks, by eliminating the need to depend on intermediaries on many of the traditional functions banks provide, or simply being a new player on the scene that is able to offer those functions in a far more superior way.

As we can see, the old banking world and the new blockchain-based money world are converging towards a common direction: a digitally open and easy programmable money infrastructure.

This infrastructure ideally shall cover all the new assets arising from the financialization of everything we covered in Part 1. I believe that it would be on this infrastructure that the future banking experience will be built.

Genping Liu is a partner with Vertex Ventures Southeast Asia and India fund.

Genping Liu is a partner with Vertex Ventures Southeast Asia and India fund.

Vertex Ventures Southeast Asia and India is part of the Vertex global network of venture capital funds. Its global network also comprises affiliates in Silicon Valley, China, and Israel. A trusted partner to some of the world’s most innovative entrepreneurs, Vertex supports its portfolio companies with unmatched operating experience and deep access to the capital, talent, partners, and customers they need to build truly global businesses.

This article was first published on Linkedin. Follow Vertex Ventures SEA & India Linkedin page to be updated on the upcoming third and last post of this series on Future of Banking.

TechNode Global publishes contributions relevant to entrepreneurship and innovation. You may submit your own original or published contributions subject to editorial discretion.

The future of banking: Money redefined in a financialized world (part 1 of 3)