InsurTech

Thai insurtech startup Eazy Digital raises $850,000 in oversubscribed seed round

Eazy Digital, a Thai insurtech startup that provides digital platforms for insurance companies, has raised $850,000 in an oversubscribed seed funding round. The round was led by Wavemaker Partners, with participation from Seedstars International Ventures, Wing Vasiksiri, and Sasin Bangkok Venture Club.

January 30, 2023

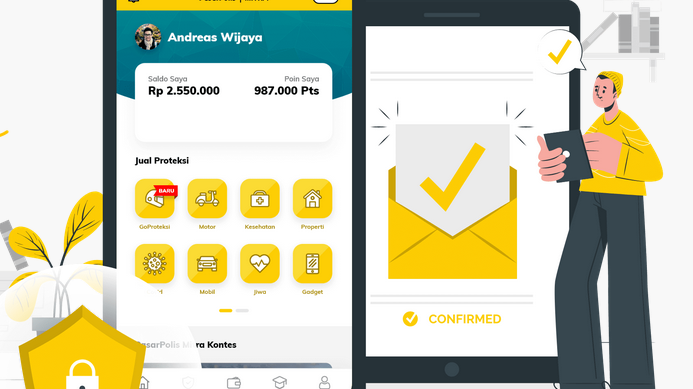

PasarPolis becomes Indonesia’s first full-stack insurtech ecosystem with new strategic partnership

PasarPolis, an Indonesia-based insurtech firm, has become Indonesia's first official full-stack insurtech ecosystem, giving the company the ability to both distribute and underwrite its own digital insurance products.

January 12, 2023

News,Thailand,Singapore,InsurTech

Bolttech partners AIS for embedded protection services in Thailand

Singapore-based insurtech bolttech, has partnered with Thailand’s mobile network operator AIS, to deliver embedded protection services including mobile device switch and replacement services to AIS customers for the recently-launched AIS Care+ programme.

January 10, 2023

Singlife with Aviva launches accelerator for Insurtech startups

Singapore homegrown financial services company Singlife with Aviva has announced the launch of Singlife Connect, its accelerator programme to support and spur the growth of promising insurtech startups.

December 22, 2022

TNGlobal Q&A and Interviews,Corporate Innovation,TechNode Event,InsurTech

Income’s Max Tiong on innovating insurance through a customer-centric and data-driven approach [ORIGIN Innovation Awards Q&A]

At Income, our lifestyle-centric and data-driven approach to insurance and financial planning puts us at the forefront of innovative solutions that empower better financial well-being for all, including the underserved.

November 29, 2022

PolicyStreet partners foodpanda Malaysia to digitise delivery partners’ insurance

Malaysia-based insurance technology firm PolicyStreet has teamed up foodpanda Malaysia to digitise delivery partners’ insurance for better protection. All of foodpanda Malaysia’s delivery partners classified as gig workers nationwide will be enjoying simplified insurance processes as part of PolicyStreet’s commitment to close the insurance protection gap…

November 29, 2022

Singapore’s Igloo raises additional $27M, bringing Series B total funding round to $46M

Singapore-based insurtech Igloo has on Tuesday announced that it has successfully raised an additional $27 million in its Series B extension, bringing a close to its Series B funding round at $46 million. The initial Series B capital raise of $19 million in March this year was led by Cathay Innovation, with further investments from ACA and other existing…

November 29, 2022

News,Vietnam,InsurTech,Singapore

Igloo launches blockchain-based weather index insurance for rice farmers in Vietnam

Singapore-based insurtech Igloo, in partnership with PVI Insurance, Vietnam Meteorological and Hydrological Administration (VNMHA) and international reinsurer SCOR, on Tuesday announced the launch of the country’s first weather index insurance - a blockchain-based parametric index insurance product that automates insurance claims of rice farmers.

November 2, 2022

Singapore’s Gigacover doubles down on transportation and logistics amidst profitability

Singapore-based insurtech Gigacover has bolstered performance through recently-inked partnerships with leading insurance brokerage firm, ComfortDelGro Insurance Brokers, and leading smart logistics platform, Zeek.

October 26, 2022

News,Investments,Singapore,InsurTech

Singapore-based insurtech Bolttech closes Series B investment at $1.5 billion valuation

Bolttech, a Singapore-based insurtech company, announced Monday Tokio Marine, alongside other shareholders, will lead its Series B funding round. The investment values bolttech at an up-round valuation of approximately $1.5 billion, one year after it closed the largest ever Series A funding round for an insurtech.

October 17, 2022