InsurTech

Year in Review,SEA,TNGlobal Q&A and Interviews,Malaysia,InsurTech,Features

Khazanah-backed InsurTech firm PolicyStreet aims to double revenue in 2026 [Q&A]

We talked to Yen Ming Lee, Co-Founder and Group Chief Executive Officer of PolicyStreet to learn more about the firm’s achievements in 2025 and its plans and aspirations for 2026. He also shared his views on the outlook of tech ecosystem in Southeast Asia in 2026.

February 5, 2026

News,Thailand,Malaysia,InsurTech

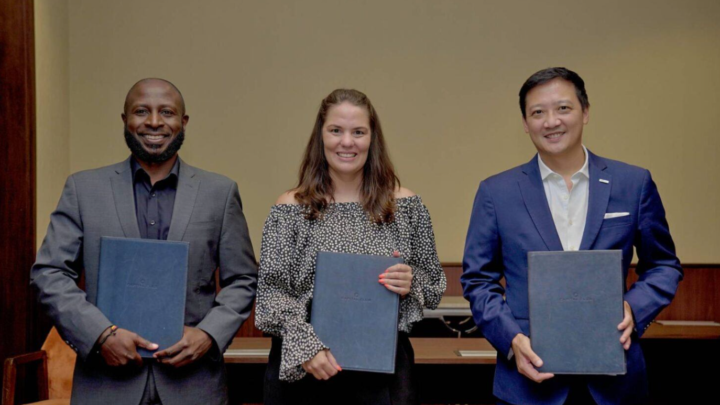

Thai Paiboon Insurance partners Mpire Mobility to provide digital solutions and services for Malaysian motorists driving into Thailand

Thai Paiboon Insurance Public Company Limited (TPB), a Thailand-based non-life insurance company, has on last Thursday entered into a strategic partnership with Mpire Mobility Sdn Bhd, a subsidiary of Greentronics Technology Berhad, to offer innovation digital solutions and services for Malaysian motorists travelling into Thailand.

January 26, 2026

Bolttech and Sony jointly launch protection program for devices

Japanese multinational electronics conglomerate, Sony, has partnered with Singapore-based insurtech bolttech, to launch My Sony Care+, an embedded protection program designed to give customers extended coverage for their devices.

January 13, 2026

Orange partners with bolttech to launch new digital insurance platform

Orange Poland, a telco provider in Poland, announced Monday the launch of “Insure with Orange”, a new digital insurance comparison platform in Poland developed in partnership with bolttech, the Singapore-based insurtech.

December 17, 2025

Vietnam’s Saladin raises Series A round led by SBI Ven Capital

Vietnamese insurtech startup Saladin has raised an undisclosed amount in Series A funding round led by SBI Ven Capital through its joint fund with Kyobo Securities from South Korea and NTUitive from Singapore.

December 12, 2025

Bolttech and Kyobo Lifeplanet partner to build out digital insurance distribution offerings in South Korea

South Korea’s digital life insurer Kyobo Lifeplanet Life Insurance and Singapore's insurtech bolttech have signed a strategic agreement to collaborate on building innovative digital insurance distribution solutions for Korea and beyond.

December 8, 2025

Singapore’s bolttech acquires Kenya’s mTek for East Africa expansion

Bolttech, the Singapore-based insurtech, announced Wednesday that it has acquired mTek, a digital insurance platform based in Kenya.

December 4, 2025

Apis Partners’ Funds lead $60M Series C in Thai D2C insurance firm Roojai

Apis Partners Group (UK) Limited, a global private equity firm focused on investments at the intersection of financial services and technology, and Asia Partners, an investor in high-growth companies across Asia, have announced a joint investment in the $60 million Series C fundraise by Roojai, Thailand’s direct-to-consumer (D2C) digital insurer.

November 26, 2025

Hong Kong’s FWD Group establishes AI Lab in Singapore

Hong Kong insurance firm FWD Group Holdings Limited announced Wednesday the inauguration of the FWD AI Lab in Singapore, a strategic move to accelerate innovation in insurance through artificial intelligence (AI) and data science.

October 10, 2025

Igloo and Telkomsel partner to offer embedded insurance in Indonesia

Singapore-based regional insurtech Igloo has partnered with Telkomsel, Indonesia's biggest telecommunications service provider, to introduce a series of innovative insurance services.

September 23, 2025

SBI to acquire Singapore digital asset platform Coinhako

February 16, 2026

SC names LCWD as first Social Exchange Platform operator in Malaysia

February 13, 2026

SBI to acquire Singapore digital asset platform Coinhako

February 16, 2026

SC names LCWD as first Social Exchange Platform operator in Malaysia

February 13, 2026