Editor’s notes: graphics, data & information provided by data platform Tracxn

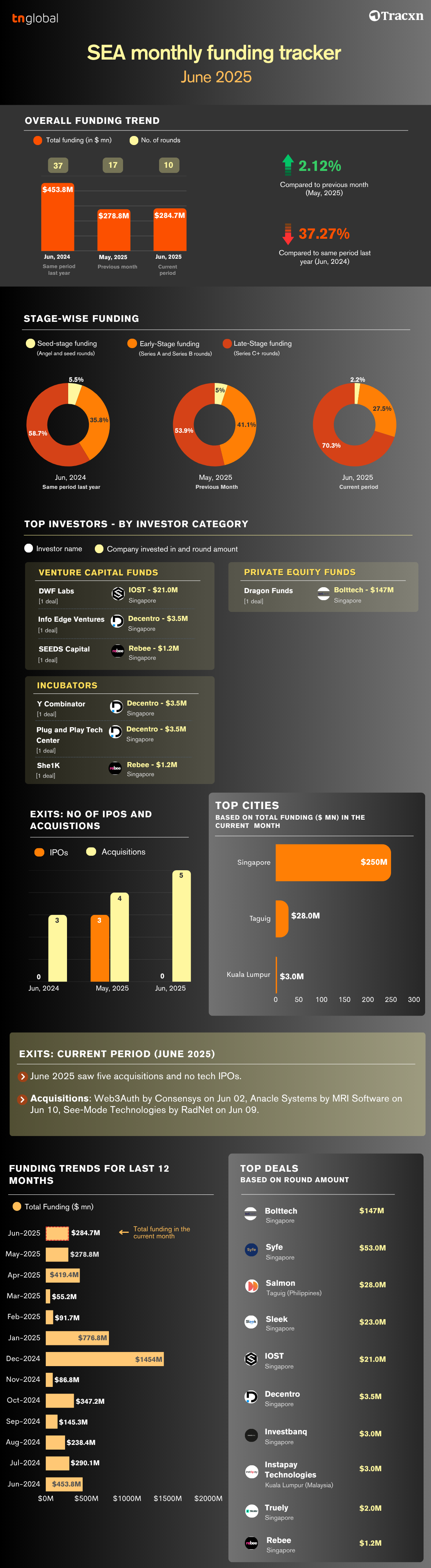

The Southeast Asia (SEA) Monthly Funding Tracker for June 2025 shows a modest recovery from the previous month, with total funding of $284.7 million across 10 rounds. This reflects a 2.12 percent increase from May 2025 but marks a 37.27 percent decline compared to $453.8 million in June 2024.

Late-Stage Rounds Dominate in June 2025

Late-stage funding formed the bulk of investments in June 2025, accounting for 70.3 percent of total funding, while early-stage rounds contributed 27.5 percent, and seed-stage rounds just 2.2 percent. This marks a significant shift in investor focus from early to later-stage startups compared to the previous month.

IPOs and Acquisitions Pick Up Momentum

June 2025 witnessed five acquisitions and no tech IPOs, in contrast to May 2025, which saw four acquisitions and three IPOs.

Acquisitions in June 2025:

● Web3Auth by Consensys (Jun 02)

● Anacle Systems by MRI Software (Jun 10)

● See-Mode Technologies by RadNet (Jun 09)

Top Funding Deals in June 2025

The largest deal was Bolttech (Singapore) with a raise of $147 million, followed by Syfe ($53 million), Salmon ($28 million, Philippines), and Sleek ($23 million, Singapore).

City-Wise Trends

Singapore remained the top-funded city with $250 million, followed by Taguig ($28 million) and Kuala Lumpur ($3 million). Singapore continues to dominate the SEA funding landscape.

Key Investors and Types of Funding

Venture Capital (VC) Investors: DWF Labs invested $21 million in Singapore based IOST, Info Edge Ventures invested $3.5M in Singapore based Decentro and SEEDS Capital invested $1.2 million in Rebee from Singapore.

Private Equity Funds: Dragon Funds invested $147 millon in Bolttech (Singapore)

Incubators: Y Combinator invested in Decentro (Singapore) with $3.5 million funding, Plug and Play Tech Center also invested $3.5 million in Decentro and She1K invested $1.2 million in Rebee, based out in Singapore.

Key Takeaways from the Data

1. Marginal Funding Recovery: A slight month-on-month improvement signals possible stabilization after May’s dip.

2. Late-Stage Investment Surge: Indicates growing investor confidence in mature startups.

3. Singapore’s Ecosystem Strengthens: With the lion’s share of both funding and acquisitions, Singapore’s dominance in SEA startup funding continues.