Malaysia and Indonesia are emerging as prime beneficiaries in Asean from strong global demand growth for new data centers amid AI proliferation, according to research house CGS-International.

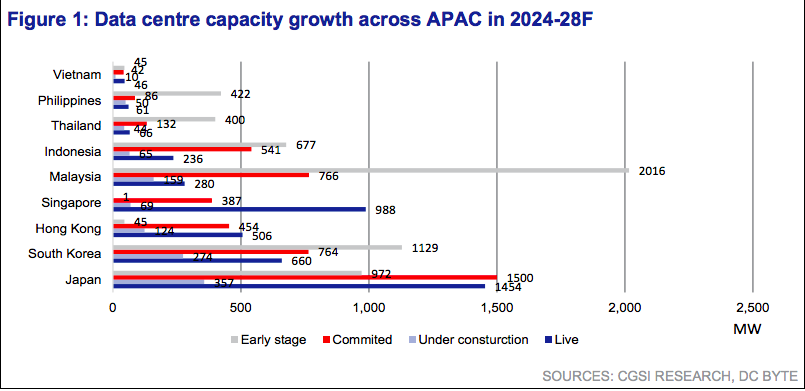

According to DC Byte, data center capacity in Asean could increase by more than fourfold from 1,677 megawatt (MW) in the first quarter of 2024 (1Q24) to 7,589MW by 2028.

This growth trend is underpinned by a rapid increase in the region’s data usage from the proliferation of internet-connected devices, additional computation demand due to increased artificial intelligence (AI) training, and land and power availability constraints in the primary markets.

“We identify Malaysia and Indonesia as prime beneficiaries of the spur in data center investment due to their location advantage, which makes them the ideal gateway for international connectivity,” the strategy note wrote.

Although Singapore currently has the highest data center capacity in ASEAN, land and power constraints have pushed operators to explore alternative locations in Malaysia, Indonesia, Thailand, Vietnam and the Philippines, according to the report titled “ASEAN Strategy:The road ahead for data centers in ASEAN.”

Based on DC Bytes projections, data center capacity in Malaysia, Thailand, and Indonesia is expected to deliver 32 percent to 56 percent Compound annual growth rate (CAGR) in 2023 to 2028, far outstripping the 8 percent CAGR forecast for Singapore.

“We expect the rise in data center demand outside Singapore to be driven by both global hyperscalers (Amazon, Google and Microsoft) and colocation providers, whose clients may require computing resources for AI development and deployment,” the analysts added.

Malaysia – likely to benefit the most from accelerating data center investment across ASEAN

The report also pointed out that Malaysia is emerging as the fastest-growing player in the data center scene within the ASEAN region, driven by several strategic advantages, such as superior infrastructure, location and favorable government policies.

“Malaysia has seen a flurry of activity in the data center space since 2019. Good connectivity, reliable power supply and political stability were key attractions, we believe, as demand for data center capacity in the region expanded,” the report noted.

The Singapore government’s decision to place a moratorium on power and land for data centers in 2019 provided an added shot in the arm for demand for data center capacity in Malaysia, especially in the state of Johor, which is ranked as the 7th largest data center market in Asia by Cushman & Wakefield as of 1Q24, the report wrote.

According to DC Byte, the Malaysian government has been supportive of the data center industry, with Malaysia Industrial Development Authority (MIDA) and Malaysia Digital Economic Corporation (MDEC) establishing a Digital Investment Office as a one-stop center to ensure faster processes and approvals.

Meanwhile, Johor’s proximity to Singapore with potential dark fibre connectivity could mean reduced latency and better cost control.

DC Byte also mentioned in its Mar 24 global data center report that, to streamline power approvals, the Malaysian authorities launched the Green Lane Pathway initiative in 2023 to reduce the duration required to power a data center to as little as 12 months.

Money pouring into the development of cutting-edge AI models

According to Bloomberg consensus forecasts, capex for major tech companies, namely Meta, Microsoft, Amazon and Google , is expected to increase substantially by 29 percent year-on-year to $177 billion in 2024. The surge in investment is led by hyperscalers’ development of proprietary large language models (LLM) for their cloud infrastructure, the analysts opined.

Indonesia – steady growth in data centers

By the end of 2023, total data center capacity in Indonesia reached 514MW, estimated the Indonesia Investment Authority (INA).

“We believe this will further increase to 1.41 GW by 2029F, driven by Indonesia’s digital economic transformation, shift towards cloud computing, Internet of Things (IoT) technology and wider usage of artificial intelligence,” the report said.

According to CGS-International, another driver of Indonesia’s data center potential is its rapidly growing tech-savvy population and the accompanying surge in data usage.

Under the “Making Indonesia 4.0” strategy, which aims to shift the economy towards advanced digital technologies, the Indonesian government has introduced a range of tax and non-tax incentives to foster growth in the data center industry.

These incentives include:

• Up to 10 years of tax holiday and exemption from withholding tax on dividends.

• Simplified procedures for repatriating profits.

• Relaxation of foreign ownership restrictions, including allowing foreign entities to own land for data center projects.

Nonetheless, the data center market in Indonesia is fragmented, with approximately 68 data center companies in Indonesia, based on forecast by a market research firm Research and Markets. There are four main cities where most of the data centers in Indonesia are located given their unique advantages in supporting the expansion and efficiency of data center operations in Indonesia.

Notable partnerships and investments in recent years include major initiatives by Google, AWS and Microsoft, and collaborations with local companies like Telkom Indonesia, Indosat Ooredoo and XL Axiata. These efforts are aimed at enhancing cloud infrastructure, developing advanced data services, and expanding data center capabilities across Indonesia, the report added.

The data center industry in Indonesia is booming, driven by increasing demand for digital services and significant investments.

However, CGS-International’s analysts think several key challenges need to be addressed to sustain and accelerate this growth.

This includes:

• Power availability and reliability

One of the primary challenges is ensuring a stable and reliable power supply. Data centers are energy-intensive and Indonesia’s power infrastructure is still developing, in our view.

Furthermore, development of green data centers is hampered by Indonesia’s relatively low renewable mix of only 13 percent in 2023. These challenges are compounded by regulatory complexities and the need for cost-effective electricity production.

• Regulatory environment and bureaucracy

Bureaucratic inefficiencies often make doing business more expensive and challenging. While the government has made strides in improving the regulatory framework, including enacting the Personal Data Protection Law (PDP Law) in 2022, inconsistencies and delays in regulatory processes still pose significant hurdles for data center operators

• Natural disasters

Indonesia is prone to various natural disasters, such as earthquakes, tsunamis, and volcanic eruptions. These natural risks pose a significant threat to data center infrastructure. Ensuring that data centers are built to withstand such events (e.g., achieving Tier 4 certification for resilience) is crucial but also increases the complexity and cost of development.

• Skilled labour shortage

There is a notable shortage of skilled labor in the data center industry in Indonesia, if compared to Singapore’s data center industry. Developing and maintaining advanced data center operations require highly specialised skills that are currently in short supply in the country. This gap necessitates investment in education and training programmes to build capable local workforce

• Infrastructure development

Beyond power, other infrastructure components, such as Internet connectivity and physical structures, are crucial. While projects like the Palapa Ring have improved Internet connectivity across Indonesia, regions outside major urban centers still face challenges. Slow infrastructure development in potential data center hubs like Batam Island could hinder the overall growth potential of the industry, the report added.

Malaysia to tap Chinese investors to build more data centers – report