Nearly one in two businesses in Singapore expressed a strong need for innovative fintech solutions to tackle business concerns, according to a recent study on business to business (B2B) cross-border payments published by global fintech leader Rapyd on Tuesday.

Despite the accelerated adoption of digital payments across businesses and consumers in recent years, there is a consensus among local businesses that fintech solutions can be further improved to better serve their specific needs, the study showed.

While innovations have been made within consumer payments, it said they have not been carried over to B2B transactions.

It said many Singapore businesses making B2B payments still rely on expensive wire transfers and slow bank transfers to make and receive payments overseas, hindering the efficiency of cross-border transactions.

Singapore businesses maintain confidence on global outlook

According to the study, Singapore businesses have emerged as cautious optimists when it comes to their perceptions of market conditions.

Approximately 60 percent of respondents from Singapore expressed confidence in prevailing market conditions, indicating a measured level of trust in their business environment.

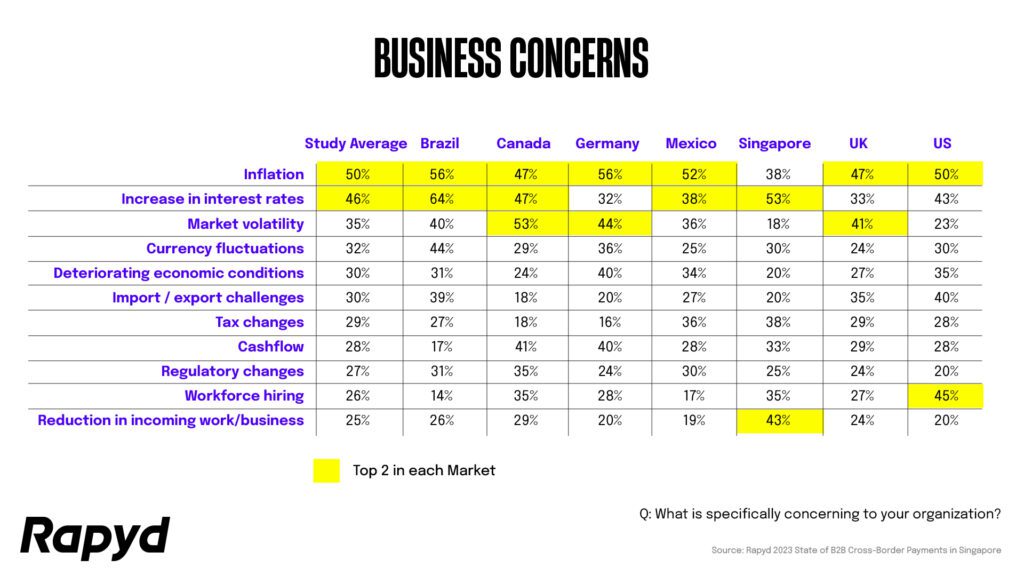

Moreover, while the majority of the markets surveyed have listed inflation, increasing interest rates, and market volatility as top concerns, Singapore businesses have taken a different stance.

They have rated market volatility and economic stability as the least troublesome, highlighting their confidence in Singapore’s position as a robust global business hub.

Conversely, local enterprises have identified increasing interest rates (53 percent) and a reduction in incoming work (43 percent) as their primary concerns.

This indicates that Singapore businesses are closely tracking financial developments and their potential impact on the demand for their products and services.

Payments take a toll: Singapore businesses reported biggest delays and costlier transactions

Meanwhile, one of the ways for companies to increase their profits and tackle financial anxieties is by improving business efficiency and cutting down on operational expenses.

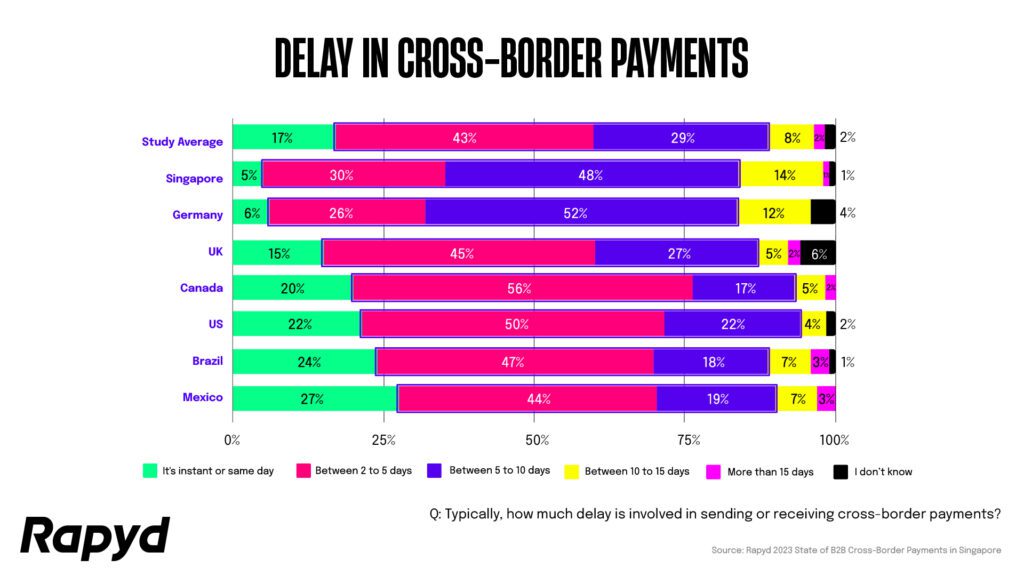

Notably, payment delays have surfaced as a substantial operational hurdle experienced by businesses throughout the markets surveyed.

Among the seven markets, Germany and Singapore reported the greatest payment delay.

Singapore businesses reported a two to ten days delay, and in many cases, even more than 10 days delay in sending or receiving payments.

The delays could be attributed to the fact that a significant portion of Singapore enterprises still lean on traditional wire and bank transfers for making and receiving payments.

Many businesses have deep-rooted relationships with traditional banking methods and, as a result, gravitate toward these long-standing practices.

The resulting delays add complexities to cross-border business operations, impacting cash flow, supplier relationships, and overall business efficiency. Such delays underscore the critical need for efficient and reliable payment solutions to facilitate seamless cross-border transactions.

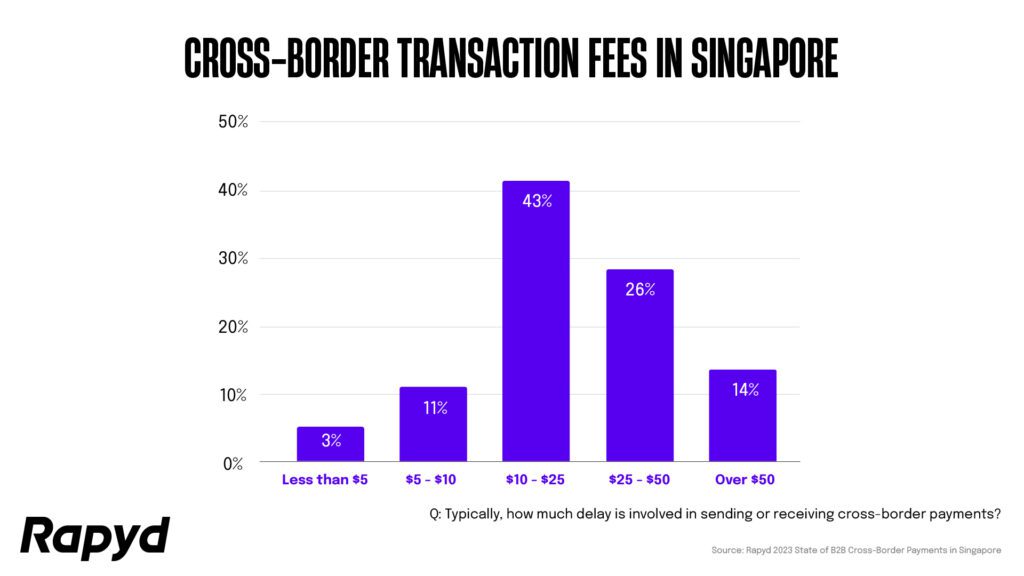

Further, the Rapyd research also highlighted that 43 percent of B2B companies in Singapore incur cross-border fees ranging from $10 to $25 per transaction.

This rate is above the average observed across the surveyed markets, where approximately 36% of businesses face cross-border transaction fees within the same $10 to $25 range.

These elevated costs can hinder growth, limit expansion opportunities, and strain resources, posing a direct challenge to firms striving to capitalize on cross-border commerce and highlighting larger inefficiencies in the system.

48 percent of Singapore businesses hope innovative payment technology can solve their challenges

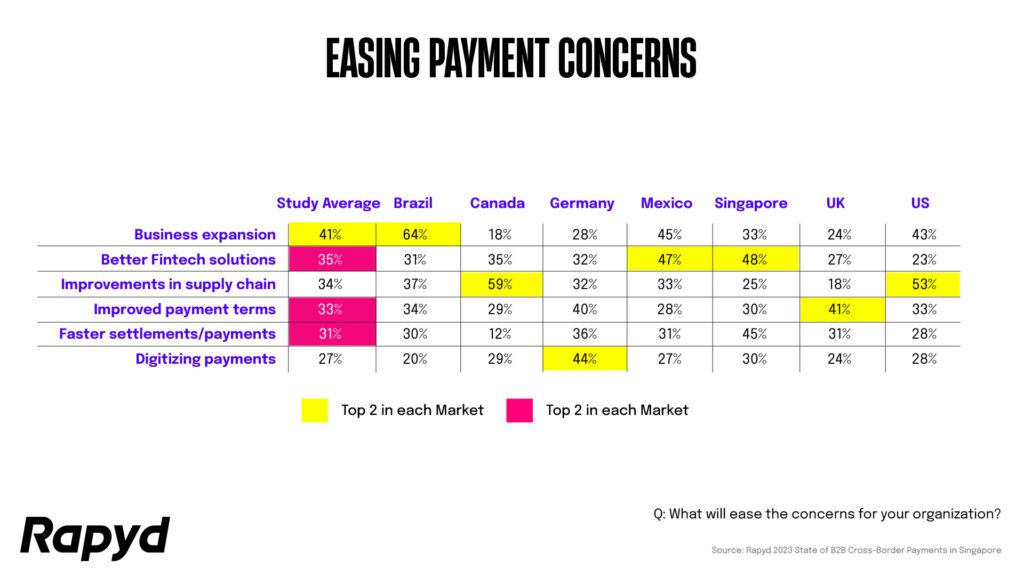

The study also showed a growing number of businesses in Singapore today realize the imperative for change.

It said digitization is no longer a luxury but an absolute necessity.

It noted that nearly half – 48 percent – of respondents from Singapore identified ‘Better Fintech Solutions’ as the paramount factor in addressing their most pressing business concerns.

This percentage surpasses any other category in Singapore and demonstrates that B2B businesses in the country prioritize fintech as a way to solve business problems more than their counterparts in any other country surveyed.

Despite Singapore being one of the world’s most advanced payment markets, it said many B2B businesses have yet to adopt digital payments.

This presents a valuable opportunity for these enterprises to collaborate with innovative fintech firms and embrace modern payment solutions to harness the full benefits of real-time Payment networks and streamline payment processes to enhance their operational efficiency.

Moreover, it said Singaporean businesses themselves are displaying a strong commitment to digitization, particularly for expediting payment processes.

According to the study, approximately 38 percent of these businesses consider it a top priority, with an additional 29 percent identifying it as one of their primary objectives.

This approach aligns with local government initiatives, which have introduced numerous schemes to encourage businesses to digitize and integrate financial technology into their operations.

“Our latest B2B cross-border payment report highlights Singapore’s strong confidence in its business environment, while also showing a widespread desire for efficient and cost-effective fintech solutions,” said Arik Shtilman, Chief Executive Officer and Co-Founder of Rapyd.

“We understand how important it is to be efficient and adaptable in today’s ever-changing business world,

“With our recent addition of card acquiring services to our Fintech as a Service platform in Singapore, we’re doubling down on our promise to provide the innovative fintech solutions Singapore businesses are looking for that will empower them on their payment journey and help them handle payment complexities with confidence and ease,” he said.

Chubb survey: digital wallet race intensifies as banks, FinTechs invest in Insurance