The world is so interconnected that the butterfly effect is so prevalent.

A color revolution in Kazakhstan knocked out the internet, and ~12 to 16 percent of the BTC Hashrate went offline. That sent BTC and other crypto prices on a downward spin the last few months. This brought DeFi and many Swap mechanisms into a huge period of uncertainty, as many different crypto ecosystems saw deep red, resulting in losses of:

- The real world (such as lesser payout for play-to-earn game resulting in tokenomics shift, Web3 income dropped;

- Crypto world (global market cap dropped 43% from $2.8T to $1.6T); and,

- Metaverse (investment-driven DAO not able to transact).

The strange thing is, the butterfly effect connection is the crypto mining network. So that means crypto is a real deal; it is here and in the mainstream. We can no longer ignore it or cast it as some geeky plaything.

Turning our attention to Carbon Credits, a concept or mechanism to manage human carbon emissions that are created literally out of thin air (there is still no internationally agreed standard). Under the legally binding COP (conference of parties), NDCs (National Determined Contribution), and ETF (Enhanced Transparency Framework), the world is taken on a ride by politicians and lawmakers to use Carbon Credits to manage their carbon footprint.

No one can escape by 2024. When something like carbon credits are consumed and traded commonly, it is highly likely to morph into a common currency. And it is not far-fetched to postulate that this common currency could be Carbon Credits replacing what we are using now, within the next eight years when everyone and every country must fully implement their NDC.

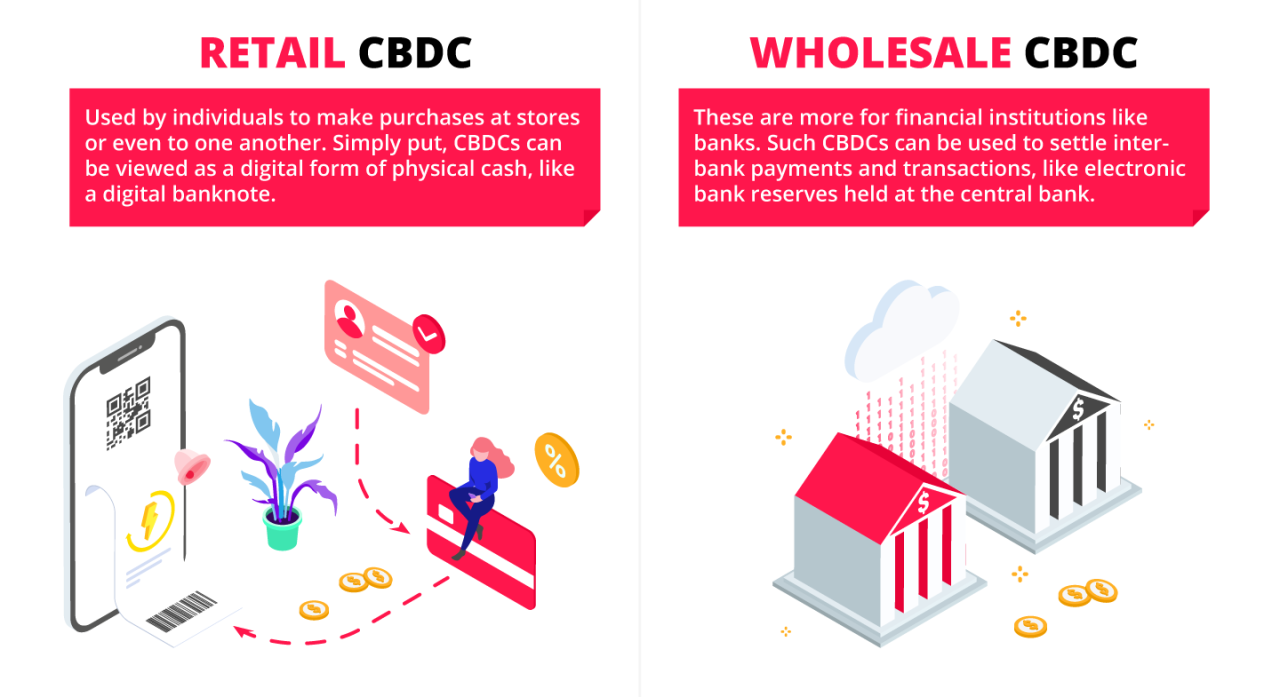

Since the nature of Carbon Credit is virtual and has to be tradeable, it would also not be too far out to postulate it will be in the form of crypto or build upon the emerging CBDC (Central Bank Digital Currencies). Why? The technology is mature — more countries are researching/ implementing it, and it is relatively secure.

However, that is of least concern. What concerns us is the impact of harvesting and using Carbon Credit as a common currency and resource.

Drawing experiences from the gold mining and oil digging era, it is always about control of resources. Those in control of the technology to harvest the minerals can endlessly exploit countries with the mineral resources but are unable to harvest. The ones who made the most money during the gold rush were selling the pickaxes and wheelbarrows. Similarly, the petroleum companies are making more money than the countries with the oil reserve.

The current international rules and regulations for MRV (Measurement Reporting and Verification) are not confirmed. Therefore, the discussions and negotiations are mainly between the developed countries with large groups of scientists and trained climate negotiators. The developed nations will not disadvantage themselves in the negotiation, and hence the developing nations who are unfamiliar with this space/pay little attention to this will likely be disadvantaged or exploited.

In the future, the MRV rules define Carbon Credit generation, countries that can find ways to generate more credit, i.e money or Carbon Credits, have the potential to rebalance or change the balance of the current geopolitical situation.

As wars, hot or cold, are fighting for control of resources, be it trade, trade routes, or mineral resources, the future conflict may be sparked by MRV and control of carbon-generating resources. With carbon credit being a virtual resource and value (think of KlimaDAO), the coming war(s) for control may also be fought in the Metaverse instead.

Tying all these together, we can’t escape from a Carbon constrained world. Being public enemy number #1, Carbon will face the combined force of humanity’s intellect and action. Like it or not, companies large and small need to be ready for such a future. What can you do as a CEO?

- A simple way is to hedge your bets. Since international standards have not been agreed upon, purchasing carbon offsets or credits from a multitude of sources may ensure some wins in the future.

- Start your own forestry/carbon sink project. Even though it may not mean/ cost much now, many expect the value of credits to exponentially increase by 2030. You can also position your company as a sustainable one!

- Have plans to green your supply chain, and execute them when needed. Being a net-zero emissions company (or even a carbon-negative one) will bring you more good than harm in the future.

As we uncover more in the space between CBDCs, Carbon Credits, and the Metaverse, we love to hear your views and discuss opportunities with you at our R200 club!

#rui #r200 #climatechange #CBDCs #metaverse #carboncredits #SMEs

Zijian Khor is Senior Assistant Director at the Ministry of Sustainability and the Environment, Singapore.

Zijian Khor is Senior Assistant Director at the Ministry of Sustainability and the Environment, Singapore.

TechNode Global INSIDER publishes contributions relevant to entrepreneurship and innovation. You may submit your own original or published contributions subject to editorial discretion.