Positive views reign but is that enough for consumers to make the switch?

Despite having one of the world’s largest automotive markets, the global market share of electric vehicles (EV) on the road in Southeast Asia still remains small. With consumer adoption a critical contributor for the EV market to flourish, the team at Milieu Insight wanted to understand consumer sentiment around EVs, and what would be the tipping point for them to choose an EV for their next vehicle purchase.

By reviewing the outcome from our survey, perhaps policymakers and industry players can have some clearer takeaways and collaborate to push for tax incentives, EV infrastructure deployment, and regulations to promote EV manufacturing.

We surveyed n=1,000 consumers of legal driving age across six countries: Singapore, Thailand, Vietnam, Malaysia, Indonesia, and The Philippines (n=6,000 overall) to understand their views and sentiments toward electric cars.

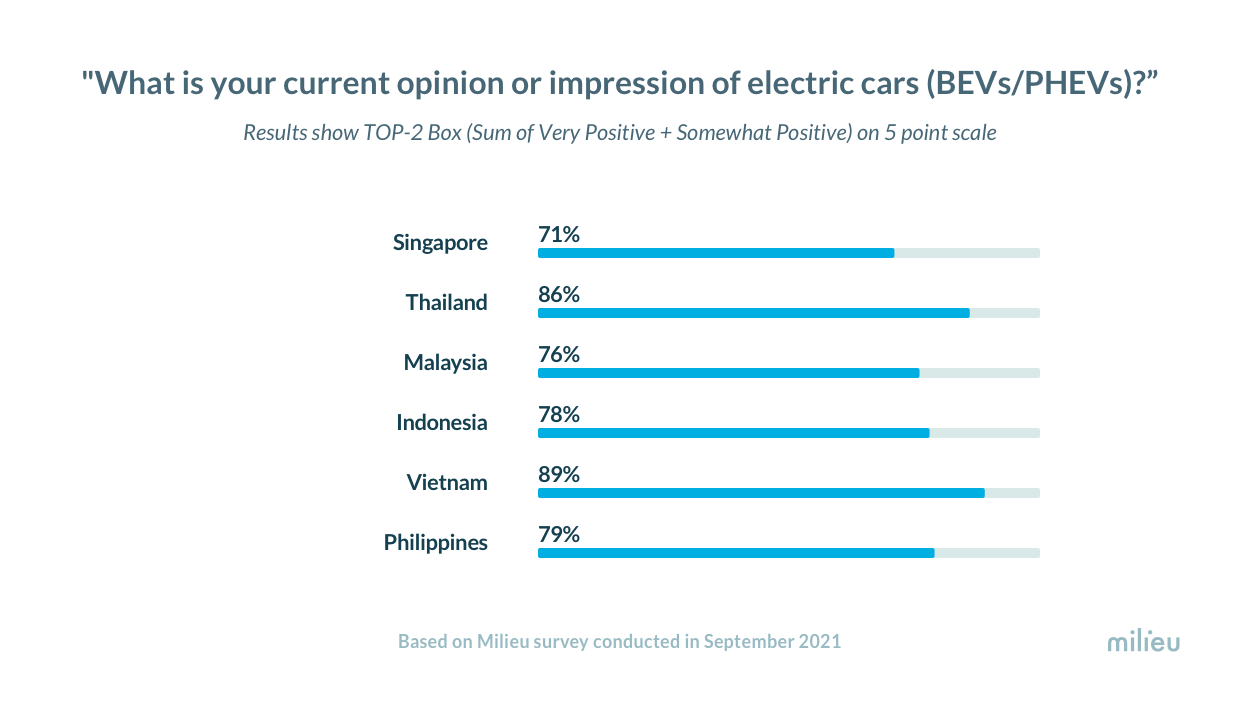

Do Southeast Asians have positive impressions about electric cars?

Most respondents had positive impressions of electric cars, with Thailand and Vietnam coming up on top. This is likely due to initiatives from regulators and industry players to drive the transition to having more EVs on the roads to promote green transportation and encourage electrification. For example, Vietnam’s flagship automaker VinFast unveiled two new electric SUVs at the 2021 Los Angeles Auto Show on 18 November. In Thailand, where the automotive industry plays a huge role in economic growth and is the country’s second largest export industry, it is also unsurprising that overall impressions towards EVs are largely positive.

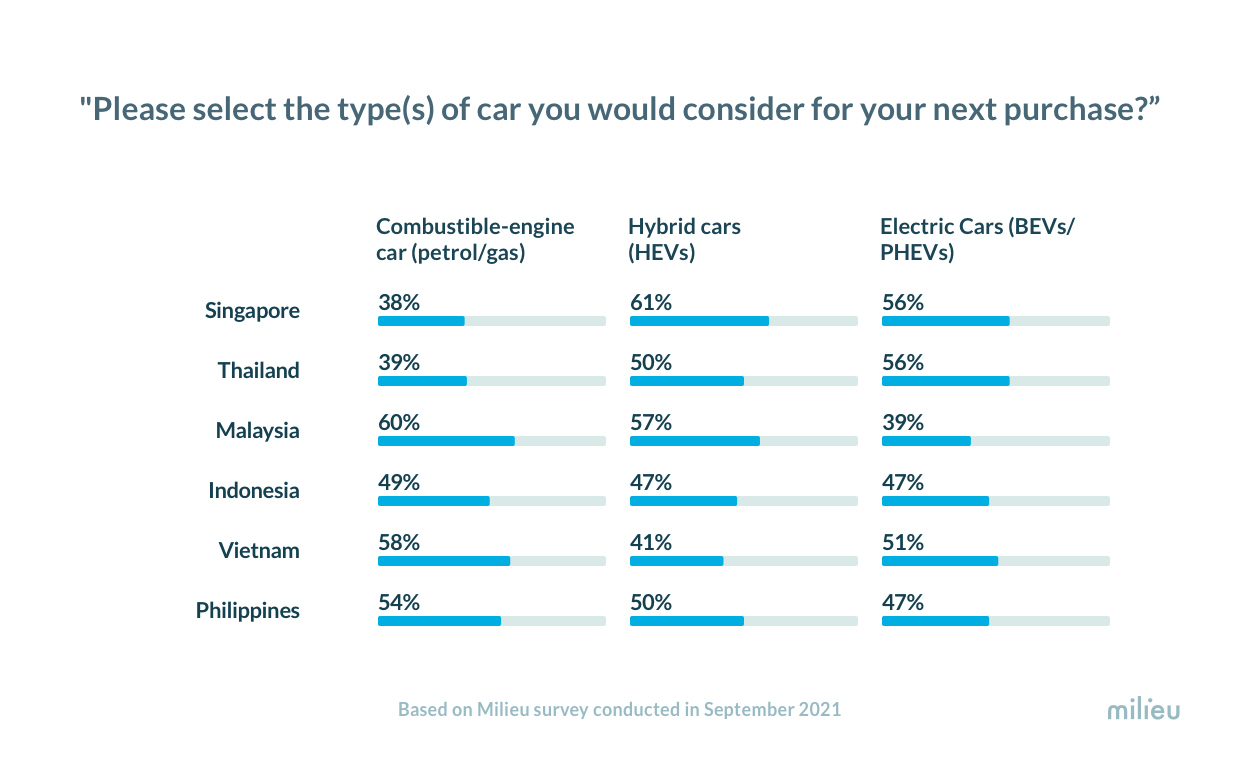

Willingness to buy an electric car as their next car

56 percent of the respondents in Thailand and Singapore and about half in Vietnam (51%) would consider an electric car for their next purchase. However, the figure is slightly lower in the Philippines and Indonesia at 47% and the lowest in Malaysia at 39 percent.

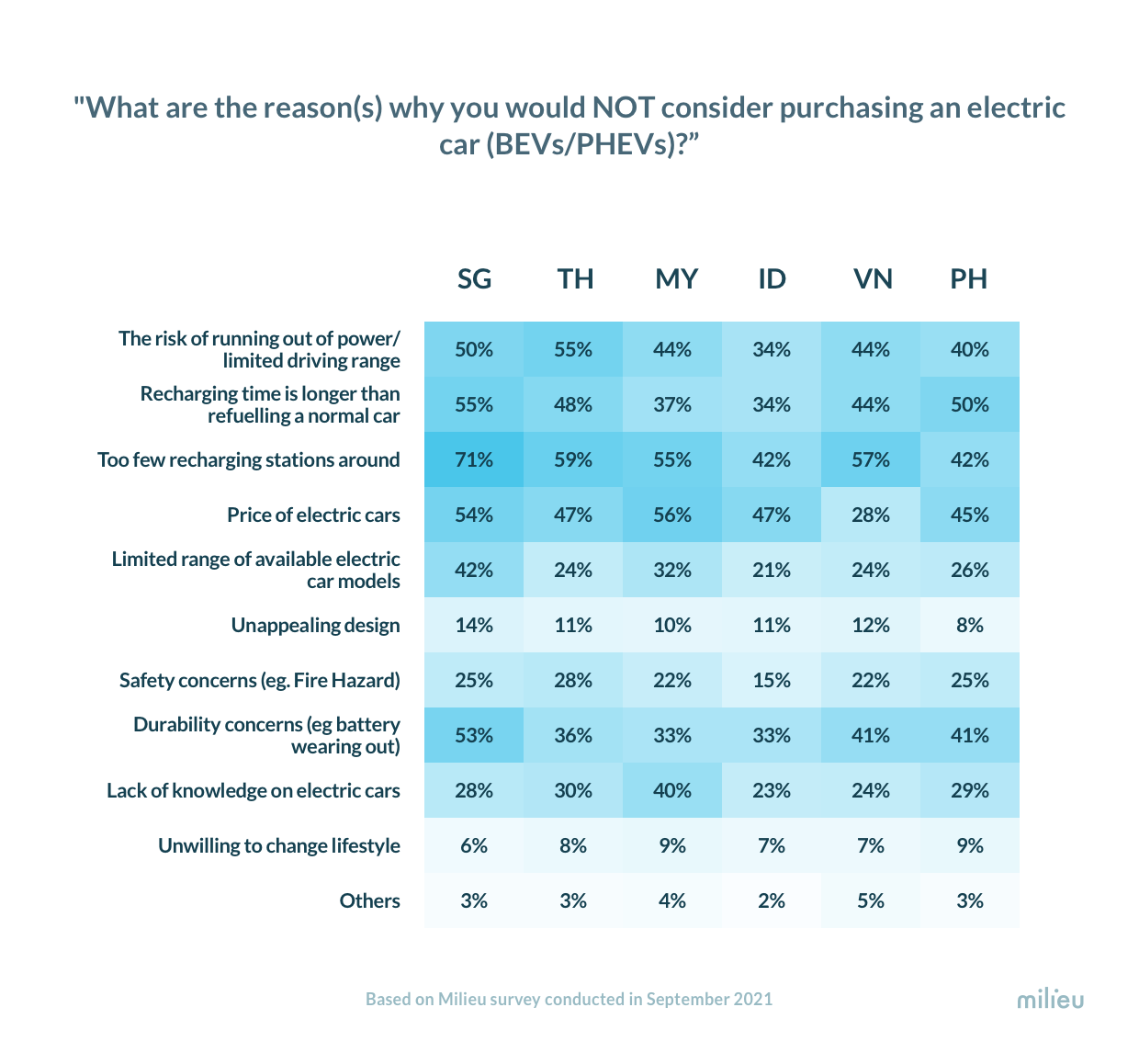

Key reasons preventing purchase of EVs

Delving deeper, some key deterring factors preventing respondents from buying an electric car were:

- Lack of charging stations;

- Pricing of electric cars was a cause of concern amongst Malaysia consumers;

- Recharging time was another deterrent;

- Limited knowledge on EVs.

Siddhant Gupta, VP Global Energy at Hexagon expressed his concerns about the limited number of recharging stations.

“Most people in major cities in the region live in vertical housing, so many of them would worry about accessibility to a dedicated EV charging point in the carparks of their high-rise apartment or even at public carparks. If the adoption rates for EV ownership rise, the localized grid today would not have the capacity to support multiple cars at the same time without grid upgrades – and these upgrades can be expensive.

Governments in Southeast Asia need to think about two main topics – making charging infrastructure available (overcoming grid constraints and increasing the count of the chargers at various locations) and making sure the Grid energy is green, or at least on a roadmap of getting greener soon. Nothing would annoy a sustainability driver more than to buy an EV and charge it with electrons coming from coal power plants.”

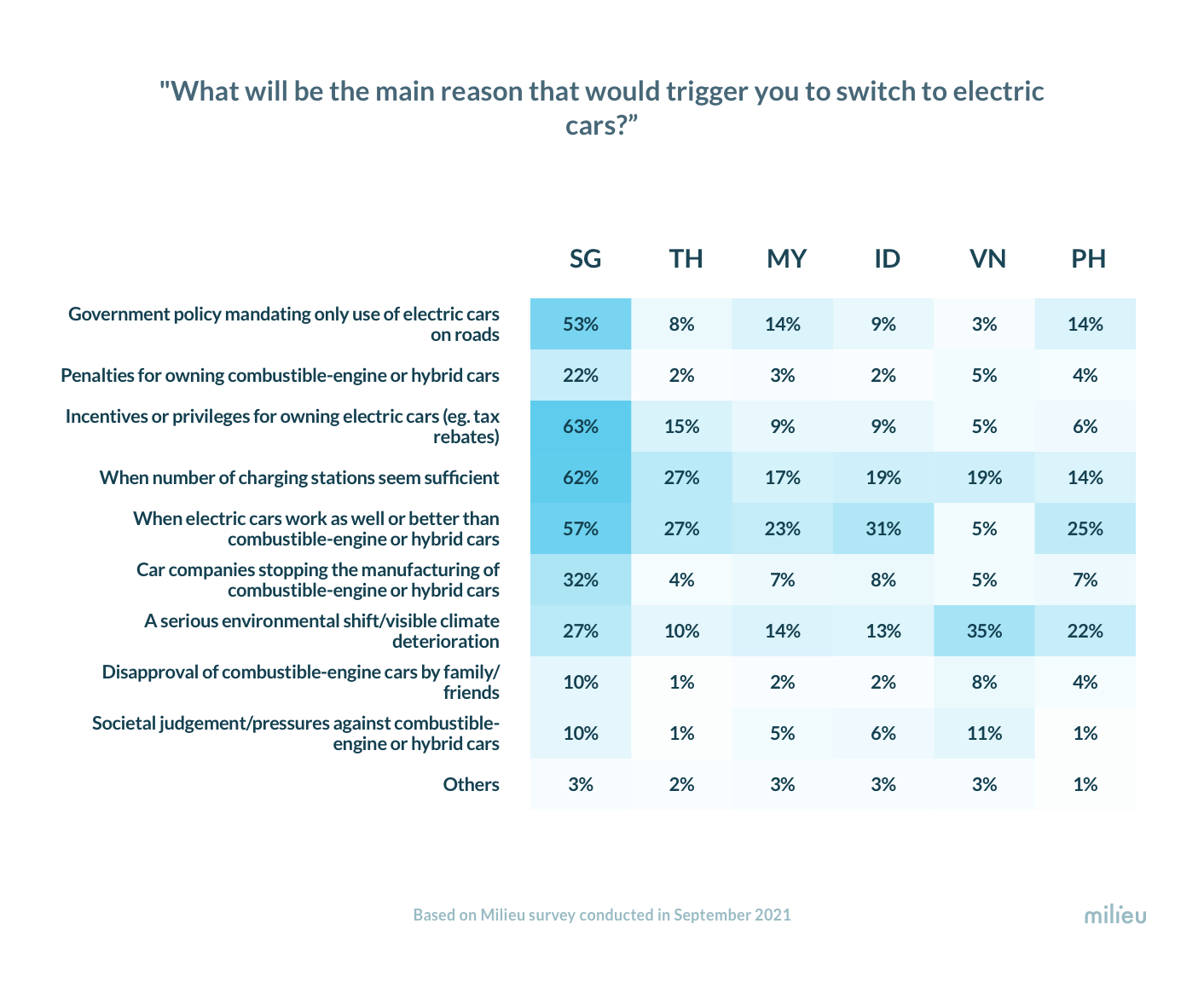

Tipping point for adoption

A large majority of respondents in Singapore (63 percent) cited incentives such as tax rebates as a key factor to influence their decision for EV car ownership. The result comes as no surprise as Singapore is one of the world’s most expensive places to own cars, with high taxes applied to limit vehicles on the road. Electric vehicles reaching parity or better than combustion engines or hybrid cars were the leading factor in Thailand (27 percent), Malaysia (23 percent), Indonesia (31 percent), and the Philippines (25 percent). Respondents in Vietnam have a differing view, with 35 percent choosing the leading trigger to be a presence of visible climate deterioration.

Dr. Sanjay Kuttan, a Council member of Sustainable Energy Association of Singapore, highlighted that there are significant savings when considering maintenance cost and energy cost/km traveled with an EV. On the back of accessibility to infrastructure and the quality of electrons from the grid, Kuttan suggests that “EV purchasing decisions should not be based on the “cost of purchase” but the “total cost of ownership.”

Siddhant Gupta, VP Global Energy at Hexagon also remains optimistic that consumer outlook will shift.

“There will be a big change soon in the opinion of buyers once more EVs in each category of buyer profile are launched. Hopefully, there will be more affordable options and consumers are better able to understand the total cost of ownership of electric cars. Buyers will see the benefits of lower fuel and maintenance costs and start to factor that in their buying decisions.”

There are also larger issues to consider in the near future such as how energy is generated to make EVs truly emission-free, especially with Southeast Asia being a region where coal-fired generation is quickly expanding. Also, with every country having its own views and strategy for adopting electric vehicles, Southeast Asian regulators and governments will have to face the challenge of sharpening their policies to spur mass adoption in the near future.

To know more about Milieu Insight’s consumer analytics reports, reach out to [email protected].

Methodology

This survey was conducted with N=1000 respondents each from Singapore, Thailand, Vietnam, Malaysia, Indonesia and The Philippines with respondents of legal driving age and above (18+ for SG, TH, VN, 19+ for MY, ID, PH). The margin of error is +/-3% with a 95 percent confidence level.

Sonia Elicia is Associate Director, Marketing at Milieu Insight.

Sonia Elicia is Associate Director, Marketing at Milieu Insight.

TechNode Global publishes contributions relevant to entrepreneurship and innovation. You may submit your own original or published contributions subject to editorial discretion.

Image Copyright: kasto