Other than cryptocurrencies, can something that only exists in the digital space be worth tens of millions of dollars? Believe it or not, these intangible treasures exist, and anyone can create and own them.

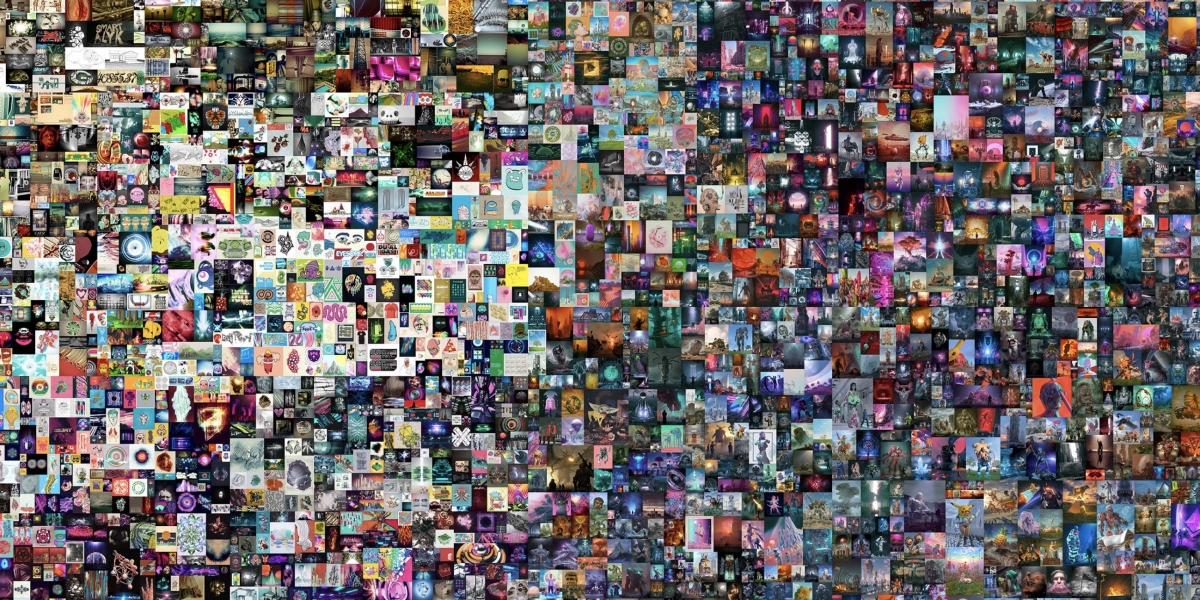

Recently, the term Non-Fungible Token (NFT) has been making rounds in the news. Just like cryptocurrency, it awed many because of the astonishing amounts in dollars they are associated with. Just recently, a digital NFT artwork by Beeple called “Everydays: The First 5000 Days” was sold for a jaw-dropping price of nearly $70 million at a Christie’s auction. Twitter CEO Jack Dorsey’s first tweet was sold as an NFT for a whopping $2.9 million.

NFTs are becoming a thing, and disregarding them at this point may not be a good idea. Skeptics call them a ridiculous fad, but proponents say this blockchain-based concept may end up following Bitcoin’s path of making many regret that they refused to be an early adopter.

Many companies have already recognized its value. The New York Stock Exchange, for one, has started “minting” its own NFTs. Marketplaces for NFTs have also emerged like Refinable, a premier NFT marketplace on the Binance Smart Chain that enables the decentralized and non-custodial creation, sharing, trading, and monetization of NFTs.

just setting up my twttr

— jack (@jack) March 21, 2006

The ABCs of NFTs

Non-fungible tokens are essentially digital assets that represent various kinds of one-of-a-kind tangible or intangible items such as music, artwork, collectible sports cards, virtual real estate. To emphasize, these are tokens that represent assets.

NFTs are assets, but they are not the asset their names say they are. For example, the person who bought Dorsey’s first Twitter tweet NFT did not buy the actual tweet. The first tweet Dorsey made on Twitter remains on Twitter under Dorsey’s account and not transferred to the Twitter account of the person who supposedly bought it. What the buyer obtained can be likened to an autographed copy of the tweet.

Who can create NFTs? Virtually anyone has the ability to make them. Many NFT marketplaces or platforms allow users to create their own NFTs through a simplified process. Refinable, for instance, enables users to digitize their content by tokenizing them into certifiably ownable and infinitely tradable goods.

What can be done with NFTs? They can be offered for sale to anyone through an auction, exchange, or marketplace. As digital assets with real value, they can also be used as gifts. They also have the potential for trade and secondary-market transactions.

“There’s going to be a slight change in the understanding and conversation about NFTs. NFTs will be seen not so much as a store of value, but really as a medium of exchange,” said Nick Chan, Co-Founder of Refinable. “NFTs and the tech that surrounds it are amazing for powering transactions and for ensuring the authenticity of assets–digital or physical,” he adds.

Can NFTs be stolen? Like in the case of bitcoins, they can be stolen if bad actors gain access to owner accounts. However, possessing a copy of the digital asset represented by the NFT does not constitute theft. Other people can get a screenshot or copy of Dorsey’s NFT tweet or a JPG duplicate of Beeple’s $70 million collage, for example, but they cannot claim to have the original copy even though their copy is very much the same as the original.

Can they be destroyed? The answer to this question is a bit unclear. Digital assets such as artwork and videos cannot be hosted on the blockchain. It would be too resource-intensive to make that happen. What is hosted on the blockchain is only the records or data that identify the digital asset. The digital asset represented by the non-fungible token resides elsewhere.

Can NFTs hold value?

The challenge is that there has been no established rule as to where the digital asset should be hosted and who should be responsible for maintaining a copy of it. To demonstrate, consider this situation. Digital Artist A sells an NFT Digital Art B, which is stored in A’s personal server, to Art Buyer C. After the transaction, A’s house burned to the ground along with his personal server. In this case, the NFT Digital Art B is lost forever. However, if art B has copies in other servers, which can be identified by the non-fungible token, the NFT art survives.

Does an NFT hold value in itself? Not exactly. As mentioned, the token represents an asset. Without the asset, the token means nothing. There may be differences in the appreciation of the value of the asset the token represents, but what is clear is that NFTs have value because people think they have value. It can be like any currency that can be subject to the law of supply and demand.

The Singapore-based cryptocurrency investor who splurged nearly $70 million on Beeple’s 21,069 x 21,069-pixel JPG art knows that others can easily obtain a copy of that artwork. However, what he actually paid for is the claim to being the owner of the creator-recognized original copy of the artwork.

Can NFTs be about tangible items?

For many, NFTs are about digital items. However, as developments in the NFT market show, the tokens can also represent tangible or real-world items. NFTs, after all, are tokens. They are designed to represent something valuable in the eyes of the creator and the buyer.

One example is Nike’s system called CryptoKick, which employs NFTs to determine whether a Nike-branded shoe is authentic. This system generates virtual versions of the original shoes Nike manufactures to be given to customers when they buy Nike footwear. As such, the buyer gets an NFT that represents an actual shoe that goes to the possession of the buyer along with a digital version of the item.

Another instance of an NFT that represents something that exists in the real world comes from professional tennis player Oleksandra Oliynykova. The Croatian athlete auctioned a part of her arm as an NFT. The winning bidder gets to claim lifetime rights to use a 15cmx8cm section on the upper portion of her arm, just below the elbow.

Jackson Aw, Founder and Chief Executive Officer of Mighty Jaxx, said that just like other decentralized tech, NFTs democratize the marketing and ownership of collectibles and other creative works. “The growing demand for better reselling options is driven by the desire to feel more confident in purchasing art in today’s context, and providing more leeway to sell will allow collectors to feel more secure in purchasing a more expensive work that might have just been out of their budget, or to buy more individual works by more artists.”

Growing popularity

Certainly, not many fully understand how NFTs work. However, many are riding the NFT bandwagon. According to NonFungible.com and L’Atelier, NFT transactions in 2020 have reached $250 million, three times the amount of transactions recorded in the previous year. The momentum has been sustained in the first quarter of 2021, as the combined market cap of major NFT projects has reportedly grown by 1,785 percent.

Most of the NFTs being traded are digital artworks. However, there has been an expansion of use cases. Other digital assets have also been minted and traded as NFTs. These include collectible items, in-game assets, music, movies, and even pornography.

The NFT market in the field of sports is notably profitable. NBA Top Shot, a site for NBA fan collectors run by the National Basketball League, already generated sales worth more than $330 million. These sales are for NFTs that feature 10 to 15-second video clips showing official game highlights.

Investing pundit Daniel Da Costa suggests that “NFTs are growing in popularity faster than Bitcoin.” The NFT market is still relatively new, but many are already flocking to it. It could be because of the fear of getting left behind like what happened to many after bitcoin reached a record high price above the $62,000 mark. It could also be due to crypto owners who are eager to use their funds on something. Of note, most NFT purchases are through cryptocurrencies.

Whatever it is, the rise of NFTs is hard to ignore. Even late-night show host Trevor Noah is talking about it.

Revolutionizing digital asset ownership

It would be unfair to say that the surging popularity of NFT is just hype. Arguably, it has the potential to revolutionize the digital asset market. The use of blockchain technology to claim ownership of digital and tangible assets is a boon to investing and the commercialization of assets.

In the case of Beeple’s famous collage, for example, the NFT also serves as a smart contract that automatically gives Beeple a 10 percent cut every time his artwork is sold to a new owner. This arrangement is an excellent demonstration of how artists and digital creators can benefit from their work. They don’t just sell their work and forget about it. They can also retain royalties.

“I’ve gone from doing big shows, with Justin Bieber filling 70,000 people in a stadium, to nothing for the second year running. So NFTs have been a godsend for us in terms of being able to make money again,” Beeple said in an interview with The Art Newspaper. “A bunch of people like me have seen their work go completely,” Beeple noted as he explained how it is advantageous to have smart contracts that allow artists to continue receiving royalties for their works even after selling them.

Moreover, there is potential for NFTs to be more than a store of value, as Refinable’s Founder mentioned. While the indivisibility of NFTs makes it challenging as a mode of transacting, the fact that they represent items of value presents an opportunity for trade in the secondary markets, much like cryptocurrencies.

With the emergence of platforms that introduce innovations on creating, trading, and monetizing NFTs, there is much to look forward to in the digital asset market. The market is new and not yet fully understood by many. There are uncertainties and fears of possible bubble bursts. However, the opportunities and possibilities abound.

The growing popularity of NFTs shows the increasing appeal and expanding applications of blockchain technology. It also evidences the growing appetite for digital decentralized investments as well as innovative ways to store value and generate gains or revenues from digital assets.

TechNode Global publishes contributions relevant to entrepreneurship and innovation. You may submit your own original or published contributions subject to editorial discretion.

Featured Image Credits: Unsplash