In the last few years, digital commerce across the Asia-Pacific (APAC) region has experienced unprecedented growth. Consumers have embraced online shopping, mobile apps, and social commerce at a remarkable pace. But this surge has brought with it a challenge that many e-commerce businesses are now struggling to manage: the complexity of digital payments.

The explosion of payment methods

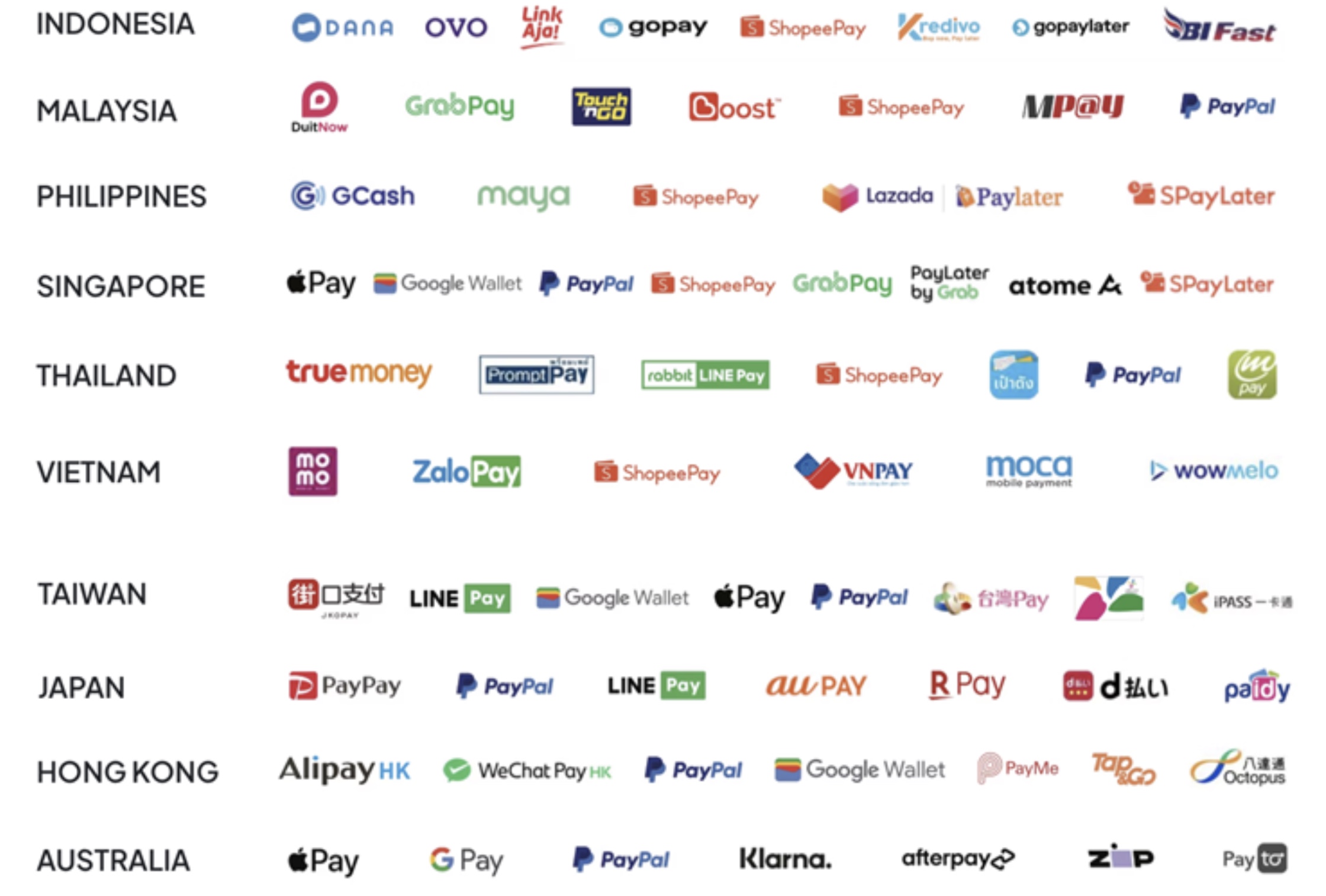

As digital adoption accelerates, so does the diversity of payment options. Where once credit and debit cards dominated, today’s consumers expect to pay via e-wallets, Buy Now Pay Later (BNPL) platforms, direct bank transfers, QR codes, and even cryptocurrency in some markets.

In Southeast Asia alone, e-wallets like GrabPay, GCash, ShopeePay, and Dana have gained significant traction. Meanwhile, BNPL services such as Atome, Kredivo, and Pace are reshaping how consumers shop. In other parts of the APAC region, domestic bank transfer systems like India’s UPI and South Korea’s KFTC are preferred modes of payment.

This rapid evolution is great for consumers—but it’s becoming increasingly difficult for merchants to keep up.

Checkout experience = conversion rate

It’s simple: if you don’t offer your customer their preferred way to pay, you risk losing them at the final step—the checkout.

According to research, cart abandonment rates soar when customers are faced with friction at the payment stage. A shopper may love your product, but if they can’t use their go-to payment app or are redirected to a clunky third-party site, they’re likely to bounce.

This challenge is especially critical in the APAC region, where payment preferences vary widely between countries, and even within them. A merchant selling across Malaysia, Thailand, and the Philippines can’t rely on a one-size-fits-all payment stack. Local relevance isn’t a nice-to-have anymore—it’s a competitive edge.

APAC: One region, many realities

Unlike the EU or the US, the APAC region isn’t a monolith. It’s a mosaic of highly localized markets—each with its own payment ecosystems, regulations, and consumer behaviors.

For example:

- In Japan, Konbini (convenience store) payments remain common for online purchases.

- In Indonesia, cash-on-delivery is still popular in Tier 2 and 3 cities.

- In China, Alipay and WeChat Pay dominate, with little room for international players.

- In Australia, card payments still lead, but digital wallets are catching up fast.

Merchants that operate—or plan to expand—across APAC must navigate this fragmented landscape. That means integrating with multiple payment service providers (PSPs), understanding local compliance rules, and constantly updating their checkout experience to match evolving customer preferences.

Enter payment orchestration

This is where payment orchestration becomes a game-changer.

At its core, payment orchestration platforms (POPs) such as Juspay provide a unified layer that connects merchants to multiple PSPs, fraud tools, and local payment methods through a single integration. Think of it as the control tower for all your payment operations.

Here’s how payment orchestration helps merchants take control:

1. Access to local payment methods—fast

Payment orchestration platforms already have pre-built connections with regional PSPs and local payment methods. That means merchants can quickly enable GrabPay in Singapore, PayNow in Thailand, or GCash in the Philippines without individual integrations. Time-to-market improves drastically.

2. Smarter routing for higher success rates

Payment orchestration can route transactions intelligently based on geography, payment method, or performance metrics. If one PSP fails or has low success rates, it automatically reroutes to another. The result? Fewer failed transactions, higher revenue.

3. One dashboard, all markets

Instead of managing payments across 10 dashboards in 10 countries, orchestration centralizes everything—settlements, refunds, dispute management, and analytics. That’s a huge operational win for finance and ops teams.

4. Simplified compliance and security

APAC markets have diverse regulations around data privacy, KYC, and payment processing. Payment orchestration platforms streamline these complexities and offer tokenization, fraud detection, and PCI DSS compliance out-of-the-box — reducing the regulatory burden on merchants.

5. Future-proof your payment stack

The payments landscape is constantly evolving. A new BNPL service might take off next quarter; a central bank digital currency (CBDC) might launch next year. With orchestration, merchants can plug into new methods quickly—without rebuilding their infrastructure.

The road ahead

As e-commerce matures across APAC, the businesses that win will be the ones that offer seamless, local, and trusted payment experiences. Trying to stitch together a patchwork of PSPs manually is no longer sustainable.

Payment orchestrators give merchants the agility they need to scale across diverse markets while keeping their checkout experience smooth and conversion-friendly. It’s not just a convenience—it’s becoming a necessity.

For merchants eyeing growth in APAC, the message is clear: take control of your payments before they take control of you.

Nakul Kothari is the Head of APAC & Middle East at Juspay, a global payments infrastructure platform that works with leading enterprises and banks to deliver seamless payment experiences. Nakul joined Juspay in 2019 and currently leads the company’s expansion across Asia-Pacific and Middle East regions. With over a decade of experience in payments, fraud prevention, and fintech consulting, he brings deep industry expertise and strategic insights. Nakul is also a regular speaker at major payments and fintech conferences around the world. He holds an MBA from the Indian Institute of Management Calcutta.

TNGlobal INSIDER publishes contributions relevant to entrepreneurship and innovation. You may submit your own original or published contributions subject to editorial discretion.

Photo by Blake Wisz on Unsplash