Singapore’s state-owned investor Temasek said it maintains a cautious investment stance while staying focused on constructing a resilient portfolio, given the reasonable likelihood of a recession in developed markets over the next year.

“The global economy is in a fragile state. Ongoing geopolitical uncertainties, rising inflation, surging commodity prices and severe supply chain bottlenecks have uncovered further fault lines in the global marketplace. Central banks have tightened their monetary policies to curb strong inflationary pressures. Against the backdrop of an increasingly fractious geopolitical environment and a looming climate crisis, economies are now more vulnerable, with key developed markets potentially facing a risk of recession,” the investment company said in a statement on Tuesday.

“Against these global uncertainties, our investment approach remains cautious. Our stance for the rest of the year will be guided by what the market is pricing in and the Fed’s posture,” Lim Ming Pey, Temasek Deputy Head, Organisation & People and Managing Director, Strategy Office, said during the presentation of the Temasek Review 2022. “Generally speaking, in view of the current environment, we expect to slow down our investment pace this financial year.”

“Despite slowing growth prospects and the uncertain outlook, we remain guided by our investment philosophy to generate risk-adjusted returns over the long term. We will prudently manage the risks and opportunities arising from macroeconomic and market events,” Temasek Chief Investment Officer Rohit Sipahimalani said. “Taking into account the reasonable likelihood of a recession in developed markets over the next year, we maintain a cautious investment stance while staying focused on constructing a resilient portfolio underpinned by the structural trends we have identified.”

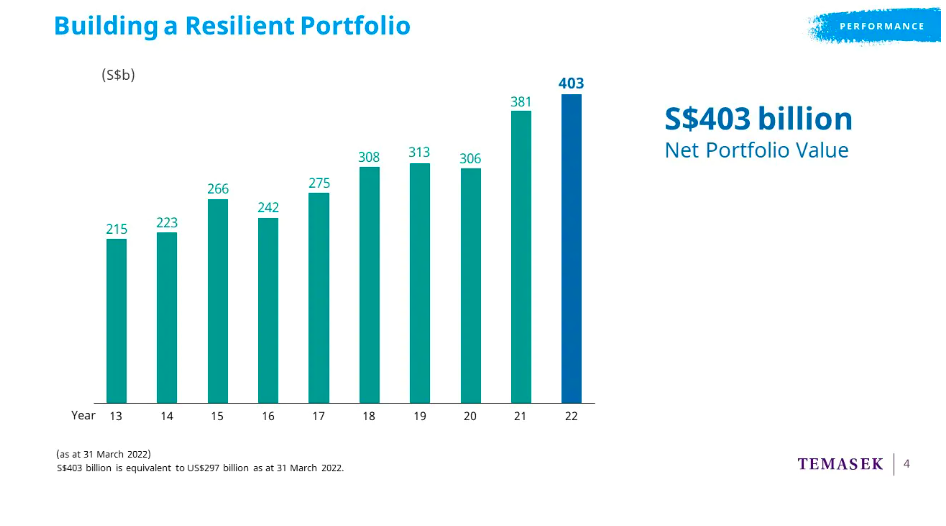

Temasek has reported a Net Portfolio Value (NPV) of S$403 billion ($297 billion) for the financial year ended March 31, 2022, up S$22 billion or 5.8 percent over the previous year.

“Our one-year Singapore Dollar Total Shareholder Return (TSR) was 5.81 percent. Our TSR since inception in 1974 was an annualized 14 percent compounded over 48 years, while our 20-year and 10-year TSRs were 8 percent and 7 percent compounded annually, respectively,” the state investor pointed out.

In the statement, Temasek has also given its views on several key markets where it has investments:

China may face challenges achieving its 2022 growth target of 5.5 percent, given weakness in its growth so far this year. Policy agencies are likely to maintain a supportive stance to buffer headwinds from soft property activity and pandemic restrictions.

In the US, the labor market remains tight and inflationary pressures continue to be strong. Against a backdrop of tightening financial conditions, negative fiscal impulse and elevated geopolitical uncertainty, growth is likely to slow meaningfully and below trend, raising the risks of a recession into 2023. A recession, if it occurs, will likely be relatively mild as healthy private sector balance sheets will provide a buffer.

In Europe, Temasek expects a “meaningful slowdown” in the second half of 2022 due to the impact of the Russia-Ukraine conflict on consumer income and business confidence. With inflationary pressures exacerbated by rising energy costs, the European Central Bank is likely to normalize monetary policy and exit negative rates by the end of this quarter. Increases in interest rates in a slowing growth environment could lead to a recession, which would be aggravated if a full Russian gas cut off occurs.

The pace of expansion for the Singapore economy may be slower than earlier projected. Even though pandemic reopening will facilitate a stronger recovery in domestically-oriented and travel-related sectors, growth prospects in Singapore’s externally-oriented economy will be weighed down by the global backdrop and a risk of recession in developed markets.

Meanwhile, during the year 2021, Temasek invested S$61 billion and divested S$37 billion.

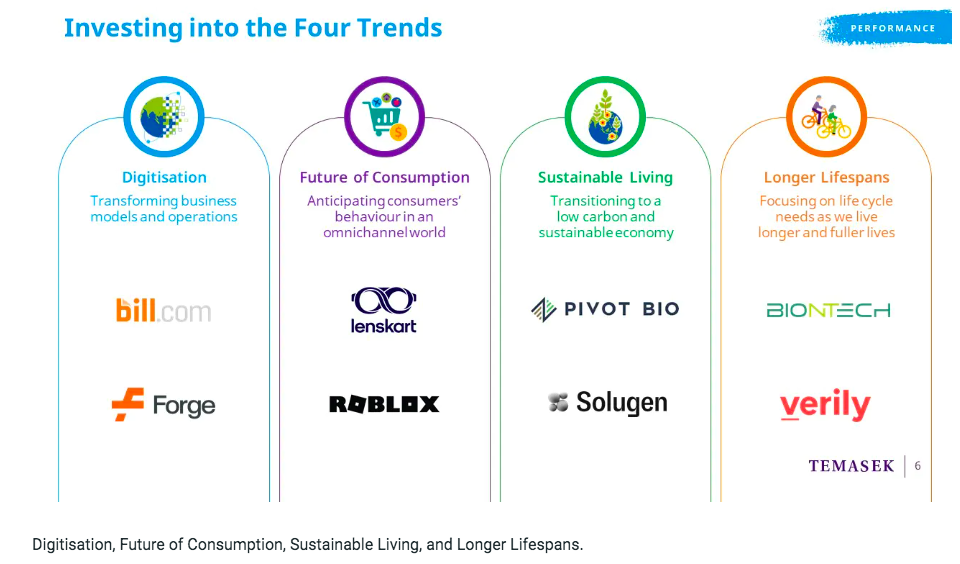

Since 2016, Temasek said its portfolio construction has been guided by its view of long term structural trends: Digitization, Sustainable Living, Future of Consumption, and Longer Lifespans.

“We have increasingly aligned our portfolio with these trends, by investing into companies that directly enable and drive these trends, as well as those that harness the potential of these trends for growth. We also engage closely with our portfolio companies as they assess potential disruption risks and transformation opportunities arising from these trends,” the firm said. “Our portfolio exposure to these trends has steadily increased from 13 percent in 2016 to 30 percent in 2022.”

Investing across Sectors and Geographies

The long term structural trends that guide its portfolio construction are interconnected, transcend sectors and countries, and continue through economic cycles. By portfolio exposure, Financial Services (23 percent), Transportation & Industrials (22 percent) and Telecommunications, Media & Technology (18 percent) are its three largest sectors.

“Guided by our view of trends and that opportunities in sectors are converging, we will continue to focus on Consumer, Media & Technology, Life Sciences & Agri-Food as well as Non-bank Financial Services companies. Together, investments in these sectors constituted 33 percent of our overall portfolio in 2022, a significant increase from their 5 percent share in 2011,” Temasek said.

Its portfolio remains anchored in Asia (63 percent). Singapore (27 percent) and China (22 percent) continue to be its two largest countries by exposure. It has continued to grow its portfolio exposure in the Americas (21 percent) and in Europe, Middle East & Africa (12 percent), in line with emerging trends and opportunities.

Its underlying exposure to developed economies, including Singapore, North America, Europe, Australia & New Zealand, increased to 65 percent, compared to 55 percent in 2011, the firm added.

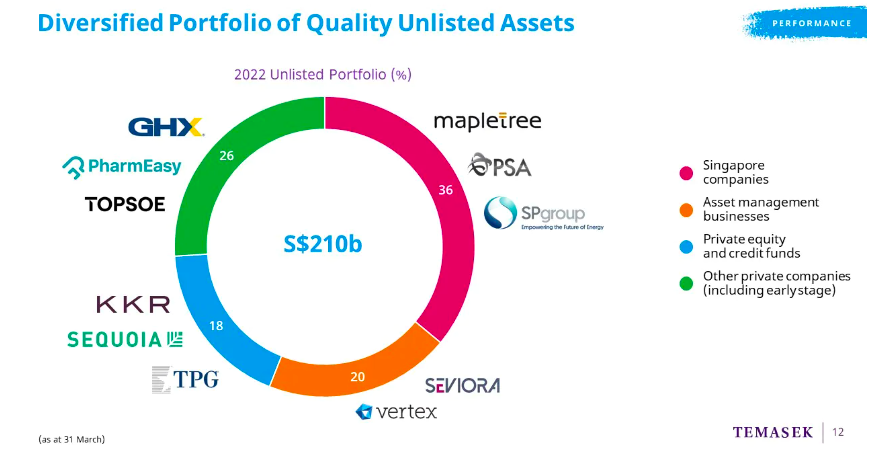

Temasek said the unlisted assets comprise 52 percent of its portfolio. These include our investments in unlisted Singapore companies (36 percent); other private companies including early stage companies (26 percent); its asset management businesses (20 percent); and private equity and credit funds (18 percent).

The unlisted portfolio offers the firm liquidity in the form of steady dividends from mature companies (such as Mapletree, SP Group and PSA), the distributions from the high-quality portfolio of funds it has built up over the years, and the returns from when its unlisted assets are listed or sold.

“Our investments in early-stage companies give us insights into innovation in technology and business models, which enable us to better assess future opportunities and segments, as well as gain a deeper understanding of potential implications for our broader portfolio. Early stage companies make up less than 10 percent of our unlisted portfolio,” Temasek said.

Headquartered in Singapore, Temasek is an investment company with a net portfolio value of S$403 billion as at March 31, 2022. The state-owned investor has 13 offices in 9 countries around the world: Beijing, Hanoi, Mumbai, Shanghai, Shenzhen and Singapore in Asia; and London, Brussels, New York, San Francisco, Washington DC, Mexico City, and Sao Paulo outside Asia.

Singapore’s Temasek allocates $3.64B for decarbonisation investment platform