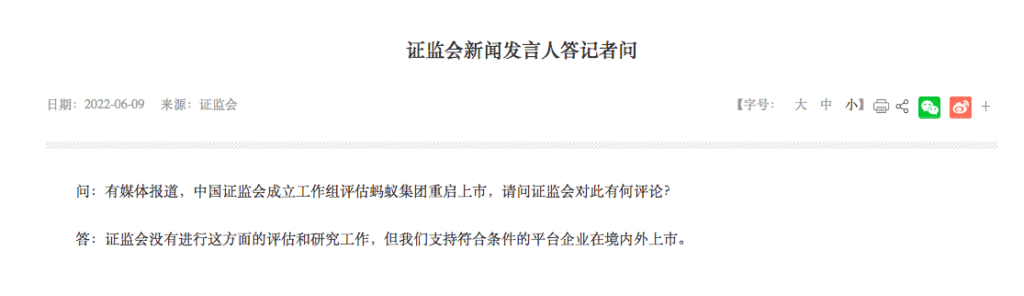

The China Securities Regulatory Commission (CSRC) said Thursday it is not conducting a review and research work on an Ant Group initial public offering (IPO).

The commission has issued a statement in response to an earlier Bloomberg report that regulators are holding early-stage discussions on a revival of Ant’s listing. The CSRC, however, also said that it “supports qualified platform companies to list within China and overseas”.

Citing people familiar with the matter, Bloomberg reported earlier that Chinese financial regulators have started early-stage discussions on a potential revival of Ant’s listing.

The CSRC has set up a team to reassess the fintech firm’s share sale plans, said one of the sources. Authorities are also nearing the final stages of issuing Ant a long-awaited license that would clear the path for an IPO and make the company regulated more like a bank, the sources reportedly said.

China’s securities regulator is initially looking at Ant’s plans for a Shanghai listing, one of the sources said. The company eventually expects to conduct a dual-listing in Shanghai and Hong Kong, according to the report.

Separately, Ant also denied it was working towards reviving its IPO.

“Under the guidance of regulators, we are focused on steadily moving forward with our rectification work and do not have any plan to initiate an IPO,” the company reportedly said in a statement on Thursday, according to South China Morning Post, a Hong Kong-based media firm owned by Alibaba Group.

Ant’s highly-anticipated planned IPO was called off at the last minute in November 2020, making headlines around the world. The dual listing in Hong Kong and Shanghai would have been the largest IPO in history.

The Chinese FinTech giant, which is controlled by billionaire Jack Ma, has recently launched a digital bank in Singapore, ANEXT Bank on Monday (June 6). ANEXT Bank is a digital wholesale bank incorporated in Singapore and a wholly-owned subsidiary of Ant Group.

Ant Group to become major shareholder of Singapore payment firm 2C2P