This article is co-authored by Sam Lee (Partner), Charles Phan (Project Lead), and Darrell Su (Senior Analyst), Capital Advisory at Paloe.

Singapore startups managed to raise up to S$11.2 billion ($8.26 billion) within the 3rd quarter of 2021, more than double the amount of S$5.5 billion ($4.06 billion) raised back in 2020 despite the ongoing challenges of the COVID-19 pandemic. As the gateway to Southeast Asia, Singapore is known as an attractive hub for startups, due to flexibility in foreign ownership and low tax rates, making it more accessible for investors.

That being said, startups are known for their high failure rate, especially at the seed stage where traction is not fully established. As a result, investors will expect a higher return of at least 10 times before exiting to compensate for the risk that they are expected to bear.

A recent position paper by ACE reported that 69 percent of surveyed startups in Singapore perceive raising funds as a “difficult task,” with half of these respondents taking 1-2 years to raise funds, citing high expectations and barriers to grants as top reasons.

Reflecting back on Singapore’s startup ecosystem, we dive into the more popular means of how startups seek financing and how new alternatives such as venture debt and revenue-based financing have become more prominent in recent years.

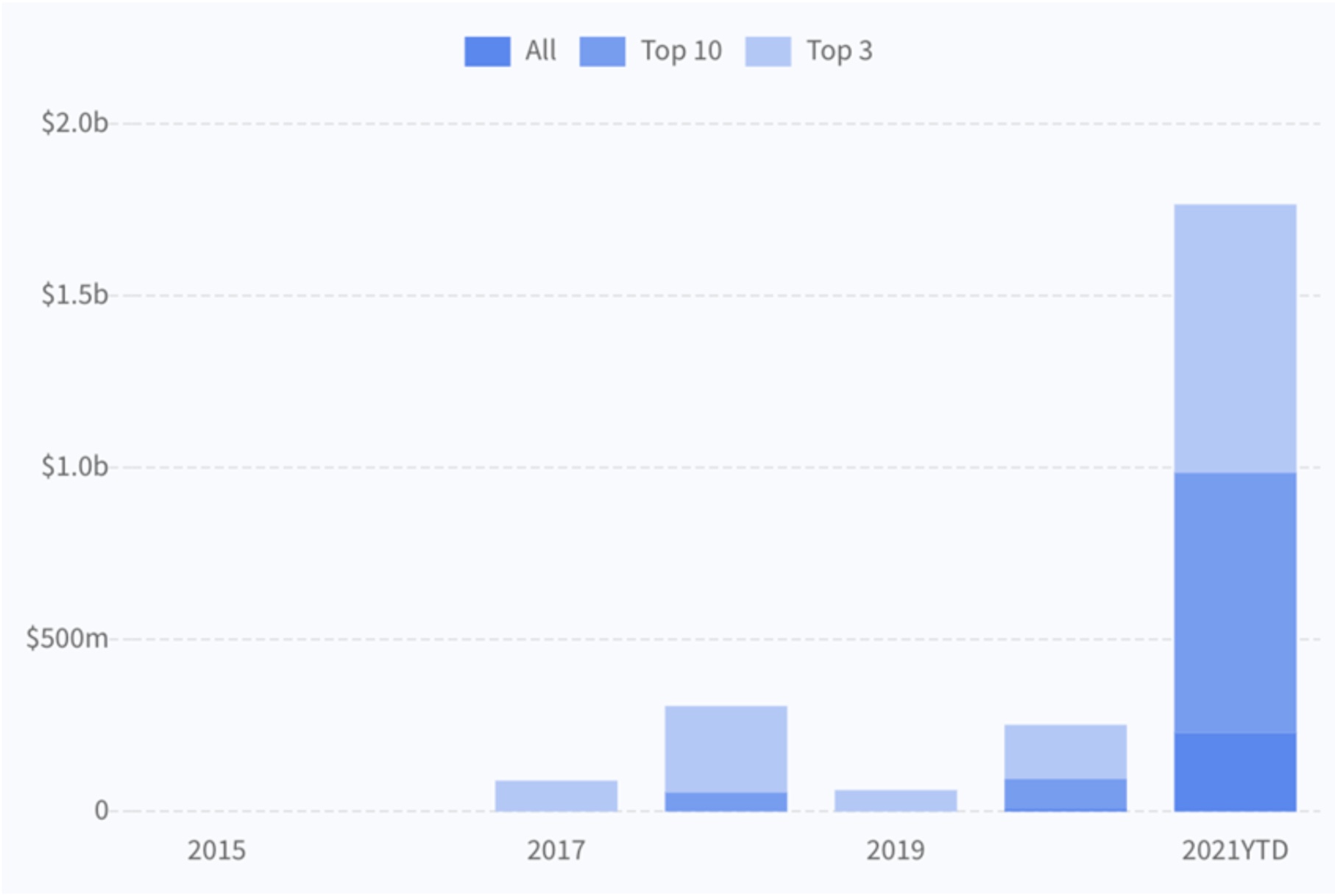

In fact, Dealroom.co reported more than 30 startups who have raised funds using revenue-based financing (through both debt and equity) for a combined amount of $1.8 billion globally, with the United States making up $1 billion and Singapore making up $6 million. This is a growth of 7 times as compared to 2020 and displays the increased movement towards alternative financing methods.

The current situation

The norm for startups is to issue equity in exchange for investors’ funds. Investors are required to wait for the next fundraise or divestment event before cashing out their stake. However, this comes with high risks. In the event a startup is not able to grow, investors face losing their investment. Another method of obtaining financing would be through a bank loan. However, bank loans are not a suitable method as startups tend not to have reliable cash flow or recurring revenues to commit to monthly repayments.

Emerging investment products such as Venture Debt have been increasingly gaining traction over recent years. In a typical venture debt structure, the startup issues warrants in exchange for capital and arranges to repay the original investment and interest in the form of a loan. The investor has the flexibility to convert the warrants into shares, usually at a discounted price based on the valuation set at the trigger event. It also allows the investor to receive capital back on a regular basis over the loan tenure. At the same time, the investor also gets to enjoy the upside by converting the warrant issued into an equity stake.

Glimpse into the future

Revenue-based equity is another emerging investment product that was adopted widely within the US and is now making waves around Southeast Asia. The investor provides growth capital in exchange for an equity stake within the startup. The startup repays the principal amount of investment through a percentage of the startup’s revenue over the investment period. Upon the trigger event, the investor also gets to cash out the full equity stake invested within the startup which will be tagged at a pre-agreed valuation cap.

For investors, this type of financing structure allows them to receive liquidity during their investment horizon by receiving a percentage of the startup’s revenue which de-risks it from the event of failure and yet enjoy the upside of a successful investment. Repayment terms shall be dependent on the startup’s revenue performance to ensure sufficient cash flow and working capital to meet the startup’s operational requirements.

For investees, founders who may not be keen on diluting too much of their equity stake are able to enjoy pro-rated repayments in tandem with their monthly revenues, unlike traditional loans which require monthly fixed repayments coupled with interest.

Currently, Singapore has two players within the revenue-based financing space. One is JenFi which has financed companies up to $6 million in 2021 while the other is Choco Up, which has financed companies up to at least $3.7 million in 2021. (Editor’s Note: Choco Up representatives reached out to us to provide clarification that Choco Up has, in fact, financed companies up to at least $50 million in 2021. Also read our interview with Choco Up Co-Founder and CEO Percy Hung.)

Successful cases

One of the successful cases includes Sideqik, who raised a round of revenue-based financing from Lighter Capital back in 2017. Sideqik is a social influencer marketing platform that helps to identify relevant influencers to target online customers and grow their communities through online promotions. The company decided to seek revenue-based financing as they preferred not to give up equity and it works hand-in-hand with their business model where their enterprise customers pay them on an annual basis. The funding grew their revenues year-on-year by 240% between June 2017 to June 2018, which allowed for rapid growth.

Another successful case includes CXA Group, a B2B health services company that taps corporations to offer their employees health benefits. Their benefits include a collection of more than 1,000 health and wellness programs and options that employees select according to their preferences. In 2021, CXA Group offloaded its brokerage business and scaled up on its Enterprise SaaS Platform. In the process of their restructuring, they have sought Revenue-Based Financing from Choco Up as they did not wish to dilute their shareholders’ capital. With Choco Up’s financing, they were able to increase their cash position by 200 percent, grew revenues by 500 percent, and tripled their valuation.

For startups who are considering fundraising without giving up equity, the revenue-based financing method is a worthy consideration as it suits startups with more predictable cash flows in industries such as SaaS. Traditional financing methods such as equity require the founders to dilute their equity stake, thus losing ownership of the startup. Whereas for debt or loans, the startup will have to shoulder the burden of monthly repayments and interest.

Emerging products like Venture Debt and Convertible Loans tend to suit startups who may be unable to repay the principal of the investment back such that founders are willing to dilute their ownership to make up the shortfall. With new alternative financing methods, startups will have access to more options and growth within the startup ecosystem.

Sam Lee is Partner, Corporate Finance and Advisory at Paloe. Since starting Paloe (formerly known as Excide) in 2015, Sam has specialised in preparing seed-stage start-ups for Series A round. He has acted as interim CFO for various tech companies during their fundraising phases. He has also built financial models for more than 70 companies and honed the art of articulating their stories using numbers. Some of the companies he has worked with include PolicyPal, Moovaz, Geniebook, USEN, Rainmaker Labs, Gobbler.

Sam Lee is Partner, Corporate Finance and Advisory at Paloe. Since starting Paloe (formerly known as Excide) in 2015, Sam has specialised in preparing seed-stage start-ups for Series A round. He has acted as interim CFO for various tech companies during their fundraising phases. He has also built financial models for more than 70 companies and honed the art of articulating their stories using numbers. Some of the companies he has worked with include PolicyPal, Moovaz, Geniebook, USEN, Rainmaker Labs, Gobbler.

Darrell Su is Senior Analyst, Capital Advisory at Paloe, with a history working in Corporate Finance roles with boutique advisory firms and External Audit with PwC Singapore. Experience includes Corporate Development, Investor Relations, Capital Markets (Initial Public Offerings, Valuation, Fairness Opinions), SGX Compliance, Financial Reporting and Internal Controls. Darrell Graduated with a Bachelor of Commerce (BCom) focused in Finance from the University of Melbourne with a 2nd Bachelor in Accounting from Curtin University of Australia.

Charles Phan is Project Lead at Paloe.

Charles Phan is Project Lead at Paloe.

TechNode Global Insider publishes contributions relevant to entrepreneurship and innovation. You may submit your own original or published contributions subject to editorial discretion.