Southeast Asia’s online food delivery spend is expected to grow more than two times faster than the total foodservice spend in the region over the next five years at a compound annual growth rate (CAGR) of 24.4 percent versus 12.1 percent, according to a food delivery report.

Growth is expected to be fastest in emerging markets such as Myanmar, Vietnam and the Philippines, with the total regional online food delivery Gross Merchandise Value (GMV) to more than triple from $9 billion in 2020 to $28 billion in 2025, 2021 Food Delivery Industry Overview report showed.

The report was released by Southeast Asia ride-hailing and food delivery unicorn Grab, in partnership with market research firm Euromonitor International on Friday. The report was based on research completed in second quarter of 2021 (Q2 2021) and seeks to provide an in-depth view into the food delivery industry over the next five years, including Southeast Asian consumers’ appetite for food delivery services post-COVID-19.

Strong growth potential through 2025

By 2025, the region’s overall prepared meal sales is projected to reach $170.5 billion, with online food delivery penetration increasing to 16.4 percent. This will be driven in part by a rising middle class and increasing smartphone adoption in Tier 2 cities.

“The majority of online food delivery transactions today are from the largest Southeast Asian cities. With infrastructure and connectivity improvements, we believe that the next wave of growth will come from smaller cities,” Russell Cohen, Group Managing Director for Operations at Grab said. “We will continue to invest in tech to bring down the overall cost of delivery and cost to serve consumers, so as to make on-demand delivery more affordable and accessible to more people.”

In Grab’s recent earnings announcement, the company reported that GrabMart’s Gross Merchandise Value (GMV) for Q1 2021 increased by 21 percent quarter on quarter compared to Q4 2020, and was 36 times higher compared to Q1 2020.

“The pandemic has accelerated the shift in consumer behavior towards buying food and groceries online. However, online grocery delivery penetration is extremely low in the region, at just over 1 percent here compared to 8 percent in China and 9 percent in the US,” he added.

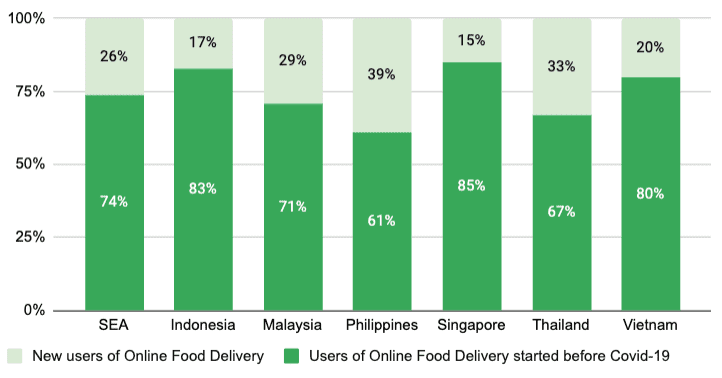

The report also revealed that about one in four (26 percent) surveyed consumers in the region were new users of online food delivery services during the pandemic. The main motivations for trying the service were to avoid dining out and to minimize contact with others, to order food for family and friends, and to enjoy exclusive promotions only available for online delivery.

While the COVID-19 pandemic has accelerated food delivery adoption in Southeast Asia, a rising appreciation for food delivery services will contribute to its sustained growth, according to the report.

Between October 2020 and March 2021, 78 percent of consumers in the region used the service once a week or more. Close to 9 in 10 consumers (87 percent) expect their usage to remain the same or increase even as COVID-19 restrictions ease. The convenience of food delivery was the number one reason for continued and increased usage post-pandemic, it added.

Featured image credits: Grab

Facebook, Bain & Co Report: Southeast Asia’s digital consumer population to reach 380M by 2026